For the exam on March 26, 2025, Class 12 CBSE Accountancy Answer Key 2025 has been provided here. The unofficial CBSE Class 12 Accountancy Answer Key 2025 PDF for all sets can be accessed below.

Class 12 CBSE Accountancy Answer Key 2025: Set-wise unofficial keys PDF download (Image Credit: Pexels)

Class 12 CBSE Accountancy Answer Key 2025: Set-wise unofficial keys PDF download (Image Credit: Pexels)Class 12 CBSE Accountancy Answer Key 2025 : The CBSE Class 12 Accountancy exam has been concluded on March 26, 2025. Following the exam, CollegeDekho experts have provided set-wise unofficial answer keys, including answers to short questions. Candidates who took the exam can refer to these unofficial keys to assess their performance and gauge their expected scores.

Class 12 CBSE Accountancy Unofficial Answer Key 2025- For QP Code 57/2/1

Check out the CBSE Class 12 Accountancy unofficial answer key 2025 for MCQs from both Section A and Section B here in the given tables:

Part A

| Question Number | Questions | Correct Answers |

|---|---|---|

| 1 | Aman, Boman and Chetan were partners in a firm sharing profits and losses in the ratio of 5:3:2. Dinesh was admitted as a new partner who 5 acquired his share entirely from Aman. Aman surrendered 1 th of his share in the profits to Dinesh. Dinesh was admitted for which of the following share in the profits of the firm ? | (C) 3/10 |

| 2. | Emily, Farida and Gauri were partners in a firm sharing profits and losses in the ratio of 4:3:1. Farida was guaranteed 35,000 as her share in the profits in the firm. Any deficiency arising on that account was to be met by Emily. The firm earned a profit of 80,000 for the year ended 31st March 2024. The profit credited to Farida's capital account was: | (A) ₹30,000 |

| 3. | Ajay Ltd. forfeited 100 shares of 10 each for non-payment of first call of 1 per share and second and final call of 3 per share. The minimum price per share at which these shares can be reissued will be: | (A) ₹6 |

| 4 | Offer of securities or invitation to subscribe securities to a select group of persons by a company (other than by way of public offer) is known as: | (D) Employee stock option plan |

| 5. | Suhas and Vilas were partners in a firm with capitals of ₹ 4,00,000 and 3,00,000, respectively. They admitted Prabhas as a new partner for 1/5th share in future profits. Prabhas brought 2,00,000 as his capital. Prabhas' share of goodwill will be | (D) ₹ 20,000 |

| 6. | Radhika, Mehar and Shubha were partners in a firm sharing profits and losses in the ratio of 9: 8: 7. If Radhika's share of profit at the end of the year amounted to profit will be: | (D) ₹ 4,20,000 |

| 7. | Wayne, Shaan and Bryan were partners in a firm. Shaan had advanced a loan of₹ 1,00,000 to the firm. On 31st March, 2024 the firm was dissolved. After transferring various assets (other than cash & bank) and outside liabilities to Realisation Account, Shaan took over furniture of book value of 90,000 in part settlement ent of of his loan amount. For the payment of alance amount of Shaan's loan Bank Account will be credited with: | (B) ₹ 90,000 |

| 8. | Nandita and Prabha were partners in a firm. Nandita withdrew 3,00,000 during the year for personal use. The partnership deed provides for charging interest on drawings @ 10% p.a. Interest on Nandita's drawings for the year ended 31st March, 2024 will be : | (D) ₹ 15,000 |

| 9. |

Assertion (A): The maximum number of partners in a partnership firm is 50.

Reason (R): By virtue of the Companies Act 2013, the Central Government is empowered to prescribe maximum number of partners in a firm. The Central Government has prescribed the maximum number of partners in a firm to be 50. Choose the correct option from the following: (A) Both Assertion (A) and Reason (R) are true and Reason correct explanation of Assertion (A). (B) Both Assertion (A) and and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A). (C) Assertion (A) is true, but Reason (R) is false. (D) Both Assertion (A) and Reason (R) are false. | (A) Both Assertion (A) and Reason (R) are true and Reason correct explanation of Assertion |

| 10. | Kajal and Laura were partners in a fırm sharing profits and losses in the ratio of 5:3. They admitted Maddy for share in future profits. Maddy 4 brought 8,00,000 as his capital and 4,00,000 as his share of premium for goodwill. Kajal, Laura and Maddy decided to share profits in future in the ratio of 2:11. After all adjustments in respect of goodwill, revaluation of assets and liabilities etc. Kajal's capital was 15,00,000 and Laura's capital was 8,00,000. It was agreed that partners' capitals should be in proportion to their new profit sharing ratio taking Maddy's capital as base. The adjustment was made by bringing in or withdrawing the necessary cash as the case may be. The cash brought in by Kajal was: | (A) ₹ 1,00,000 |

| 11 | Pulkit and Ravinder were partners in a firm sharing profits and losses in the ratio of 3:2. Sikander was admitted as a new partner for share in the profits of the firm. Pulkit, Ravinder, and Sikander decided to share future profits in the ratio of 2:2:1. Sikander brought 5,00,000 as his capital and 10,00,000 as his share of premium for goodwill. The amount of premium for goodwill that will be credited to the old partners' capital accounts will be : | (A) Pulkit's Capital Account₹ 10,00,000 |

| 12. (a) | Anisha, Deepa and Charu were partners sharing profits and losses in the ratio of 5:3:2. On 31st March, 2024, they decided to change their profit-sharing ratio to 2:35. Each partner's gain or sacrifice due to change in profit-sharing ratio will be: | (A) Anisha's sacrifice 3/10; Charu's gain 3/10 |

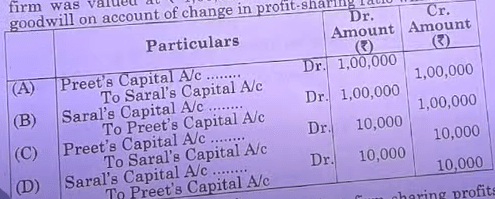

| 12 (b) |

Preet and Saral were partners sharing profits and losses in the ratio of 3: 2. On 31st March, 2024 they decided to change their profit sharing ratio to 1: 1. On the date of reconstitution goodwill of the firm was valued at 1,00,000. The journal entry for treatment of goodwill on account of change in profit-sharing ratio will be :

| |

| 13 (a) | Ishan, Jatin and Kapil were partners in a firm sharing profits and losses in the ratio of 5: 4: 1. Jatin retired and his share was taken up by Ishan and Kapil in the ratio 1: 1. The new profit-sharing ratio between Ishan and Kapil after Jatin's retirement will be : | (D) 7:3 |

| 13 (b) | Sakshi, Kiara and Gunjan were partners in a firm sharing profits and losses in the ratio of 3:2:1. Kiara retired on 1-4-2023. After all adjustments the amount due to Kiara was 5,00,000. The payment was to be made in two yearly instalments of ₹ 2,50,000 each plus interest @ 10% per annum on the unpaid balance. The amount of first instalment paid on 31-03-2024 will be: | (B) ₹ 2,75,000 |

| 14 (a) | The amount of share capital which a company is authorised to issue by its Memorandum of Association is known as | (B) Issued Capital |

| 14 (b) | According to Securities and Exchange Board of India (SEBI), guidelines, minimum subscription of capital cannot be less than 90% of | (A) Authorised capital |

| 15 (a) | Debentures on which a company does not give any undertaking for the repayment of money borrowed are called : | (A) Bearer Debentures |

| 15 (b) | If the amount of debentures issued is more than the amount of the net assets taken over by a company, the difference will be treated as: | (A) Capital Reserve |

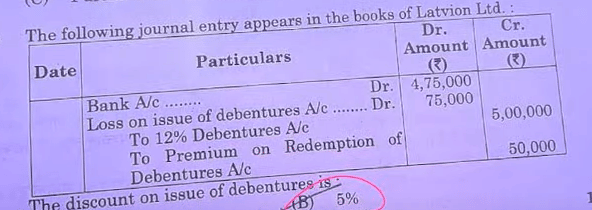

| 16. (a) |  | (B) 5% |

| 16 (b) | Zeba Limited issued 15,000, 9% debentures of 100 each at 10% discount on 1st April, 2023. It has a balance of₹ 1,00,000 in Securities Premium Account. The 'Discount on issue of Debentures' of 1,50,000 will be written off : | (A) ₹1,00,000 out of Securities Premium Account and₹ 50,000 out of Statement of Profit and Loss |

Class 12 CBSE Accountancy 2025: Exam Analysis Link

Apart from the CBSE Class 12 Accountancy unofficial answer key, the candidates can find out the exam analysis here:

Class 12 CBSE Subject-Wise Answer Key 2025 |

| Subject Name | Answer Key Links |

|---|---|

| English Core | Class 12 CBSE English Answer Key 2025 |

| Chemistry | Class 12 CBSE Chemistry Answer Key 2025 |

| Physics | Class 12 CBSE Physics Answer Key 2025 |

| Mathematics | Class 12 CBSE Mathematics Answer Key 2025 |

| Physical Education | Class 12 CBSE Physical Education Answer Key 2025 |

| Entrepreneurship | Class 12 CBSE Entrepreneurship Answer Key 2025 |

| Business Studies | Class 12 CBSE Business Studies Answer Key 2025 |

| Geography | Class 12 CBSE Geography Answer Key 2025 |

| Hindi Core | CBSE Class 12 Hindi Answer Key 2025 |

| Economics | Class 12 CBSE Economics Answer Key 2025 |

| Political Science | Class 12 CBSE Political Science Answer Key 2025 |

| Biology | Class 12 CBSE Biology Answer Key 2025 |

| Sociology | Class 12 CBSE Sociology Answer Key 2025 |

| Information Technology | Class 12 CBSE Information Technology Answer Key 2025 |

| Computer Science | Class 12 CBSE Computer Science Answer Key 2025 |

| Informatics Practices | Class 12 CBSE Informatics Practices Answer Key 2025 |

| History | Class 12 CBSE History Answer Key 2025 |

Class 12 CBSE Toughest and Easiest Subject 2025 |

| Parameters | Links |

|---|---|

| Toughest Subject | Toughest Subject of CBSE Class 12 Exams 2025 |

| Easiest Subject | Easiest Subject of CBSE Class 12 Exams 2025 |

Keep visiting CollegeDekho for the latest Education News on entrance exams, board exams and admissions. You can also write to us at our email ID news@collegedekho.com.