CA (Chartered Accountancy) Course

What is CA Course?

CA or Chartered Accountancy course is a 3 to 5 years of professional accounting and finance certification with three years of mandatory articled training period which makes one an audit specialist or expert in financial recommendations. CA Course is a very popular choice among Commerce students in India and almost 1,03,517 aspirants had appeared for CA Foundation June 2023 exam session out of which only 25,860 students cleared the exam. Administered by the Institute of Chartered Accountants of India (ICAI), the CA course comprises three levels: Foundation, Intermediate, and Final. You must study for each level and pass the exams for all the three levels to become a certified Chartered Accountant in India. The choice to take the course proves a very good one because on completion there are so many different careers that graduates can pursue within various fields involving finance and accounting. The CA Syllabus includes important CA Subjects like accounting, auditing, taxation, financial management and professional ethics among others.

Chartered Accountant course can also help you gain knowledge and know-how in fields such as practicing public affairs, corporate finance jobs, consulting among others. After completing Chartered Accountancy course, people can take up various CA jobs like becoming an auditor, financial analyst, tax advisor or even work in corporate finance.

CA (Chartered Accountancy) course duration is 3 years (for graduates/ postgraduates) to 4.5 - 5 years (for 12th passed candidates), and it is mostly opted by Commerce/ Finance students who aspire to become Chartered Accountants and begin work as experts in the area of accounting, finance, and auditing. CA Foundation exam is the first step to CA Course Admission in India.

There are two options for students who want to pursue CA programme i.e. through the foundation level after class 12th or the direct entry route after graduation. The CA salary can differ based on the amount of experience and the location ranging from Rs. 4,00,000 to Rs. 40,00,000 per year.

Table of Contents

- What is CA Course?

- Latest Updates About CA Course

- CA Course Latest News and Facts

- CA Course Highlights

- What is the ICAI CA Exam?

- Chartered Accountancy Course Eligibility Criteria

- CA Course Duration

- CA Syllabus and Subjects

- Why Choose a CA Course?

- How to become a Chartered Accountant in India?

- Direct CA Course Admission Process Without Entrance Exam

- Is CA Course available online?

- CA Course Admission Process

- Chartered Accountancy Course Fee for Foundation, Intermediate and Final

- CA Course Registration

- Passing Criteria for CA Foundation, Intermediate and Final Exam

- CA Course Comparison

- Best Books for CA Course

- Career Options After CA

- Courses To Pursue After CA

- Other Popular Courses

- FAQs about CA

Latest Updates About CA Course

Registration for CA Foundation, Inter, and Final May-June 2024 exam session has begun from February 2, 2024.

CA Foundation exam for May-June 2024 session will be conducted on June 20, 22, 24, and 26, 2024.

CA Intermediate exam (both groups) for May-June 2024 session will be conducted on May 3, 5, and 9, 2024 for Group I exam. And for Group II, the exam will be held on May 11, 15, and 17, 2024.

CA Final exam (both groups) for May-June 2024 session will be conducted on May 2, 4, and 8, 2024 for Group I exam. And for Group II, the exam will be held on May 10, 14, and 16, 2024.

CA Course Latest News and Facts

CA Intermediate and Final exam dates for May - June 2024 session have been revised to avoid clash with the 18th Lok Sabha elections scheduled for April and May 2024. Check the revised dates in the CA Course latest updates section.

CA Foundation exam December 2023 total pass percentage including males and females stood at 29.99%.

CA Intermediate November 2023 total pass percentage including males and females stood at 9.73%

CA Final November 2023 total pass percentage including males and females stood at 9.42%.

ICAI has introduced a new education and training scheme from July 1, 2023 and it will be effective from the May 2024 exams.

The CA New Scheme is in line with both global benchmarks and the National Education Policy 2020. It impacts various aspects of the CA course, including changes to curriculum, practical training duration, syllabus and subjects, paper pattern and passing criteria. This also affects exemptions, training leaves and the duration it takes to become a Chartered Accountant. Some key changes are reducing the CA articleship period from 3 years to 2 years; merging certain papers at all three levels; modifying eligibility criteria as well as registration validity.

CA Foundation June 2024 registration will now be valid for a period of four years. And after four years, students will not be able to revalidate the same.

ICAI has removed Business Correspondence & Reporting and Business & Commercial Knowledge subjects from CA Foundation Syllabus in the new proposed scheme.

Now, students will have to get a minimum aggregate of 50% or above in the CA Foundation exam to pass the same and now there will be a negative marking of 0.25 as per the proposed new scheme by ICAI.

Now, direct entry route candidates can sit for CA Inter exams only after completing a mandatory study period of 8 months.

Now, the validity of CA Inter registration is for a period of five years as opposed to four years. And students can only revalidate their registration for once only after paying the prescribed fee.

Now, there will be a total of six papers in the CA Intermediate new syllabus 2024 as opposed to eight papers earlier.

The first and fifth papers are combined, so the initial paper will be Advanced Accounting in the CA Intermediate new syllabus 2024

The Enterprise Information Systems subject is now removed from paper 7, and the subject Economics for Finance is deleted from paper 8. The rest of the part is combined with paper 6 as Financial Management and Strategic Management (50 marks + 50 marks) in the CA Intermediate new syllabus 2024.

The Companies Act will get covered fully in Paper 2 of corporate law in CA Intermediate new syllabus 2024. The part related to Business law is included in CA Foundation level.

Now, there will be 30% MCQ-based questions and 70% subjective questions along with 0.25 negative marking for each incorrect answer in the CA Intermediate new syllabus 2024.

In the CA Intermediate new scheme 2023, if you get an exemption in any paper, then it is permanent for that paper. This implies the ICAI will consider these exempted papers as permanently passed. Nonetheless, you must clear the remaining papers by achieving at least 50% marks in CA intermediate results.

Now, the CA Articleship stipend has been increased by 100% by ICAI in the proposed new scheme.

During their articleship period, students can now only take 12 leaves in a year under the new ICAI CA scheme 2023.

The new CA Final eligibility criteria under the new CA scheme 2023 is as mentioned below:

- Completion of the Advanced ICITISS Course

- Complete mandatory six months of study period after articleship completion

- Crack all the four self-paced online modules

Now, the validity for CA Final registration is ten years as opposed to being indefinite earlier.

The new CA Final Syllabus 2024 will have a total of six papers as opposed to eight papers. Now there will be two groups with three papers each.

Some of the big changes that are done in the CA Final Subjects are mentioned below:

The subjects of papers 4 and 5 are going to be taken out and incorporated into the self-paced modules.

Paper 6 will have no options because now It is a multidisciplinary case study of Strategic Cost Management subject.

Subjects that can be chosen, like risk management, financial services and capital markets are included in the Set C of self-paced modules.

The exit route will also change in the new CA Course 2023. Students who are not able to pass the CA Final exams usually exit from the CA Course. Now, we will talk about the certificate that ICAI gives to people who complete their course. In place of Accounting Technician, they are using the term Business Accounting Associate for this certification. But before getting it, individuals must meet these requirements:

- Cleared both groups of CA Intermediate.

- Complete the CA Articleship Training.

- Finished the soft skills and other IT programmes.

- Cleared all 4 self-paced modules.

CA Course Highlights

The CA highlights section will provide you with an overview of important aspects related to the chartered accountancy course like duration, course fee, top recruiters, etc.

| Course Name | CA Course OR Chartered Accountancy |

|---|---|

| Course Type | Part-time |

| CA Full-Form | Chartered Accountancy |

| CA Course Duration |

|

| Age Limit | No minimum or maximum age limit is set by ICAI to pursue the CA course. |

| CA Eligibility Criteria | For Foundation Route To be eligible to take the CA Foundation exam, a candidate must have completed their four months of required study time after registering as a CA and have passed the class 12 exam. For Direct Entry Route Following candidates can take direct admission to the CA Intermediate level:

|

| CA Course Fees |

|

| Average Annual Salary | INR 5 LPA - INR 20 LPA |

| Employment Roles | Accountant, Financial Manager, Banker, Taxation Consultant, Consultant and more |

What is the ICAI CA Exam?

The ICAI CA Exam, also called the Chartered Accountant exam, is one of the toughest accountancy exams that the Institute of Chartered Accountants of India conducts. The exam make people into qualified Chartered Accountants. First is the CA Foundation Exam; after this comes Intermediate and Final exams. Successfully finishing all the three-level exams of the CA course and doing hands-on articleship training provides you with the knowledge and trustworthiness needed to do very well in different areas of finance and accounting alon with lucrative salary offers from across the globe.

Chartered Accountancy Course Eligibility Criteria

Chartered Accountancy course's initial step is registration. Candidates must first be eligible before submitting the registration form. Check the CA course eligibility criteria for each level of the programme:

CA Foundation

To be eligible to sit the CA Foundation exam, the student must have earned at least a 50% grade in the Commerce stream of their class 12 or at least a 55% grade in the Science stream. However, candidates will only be able to give the CA Foundation exam only after registering with the Board of Studies and mandatorily studying for four months. Also, candidates are eligible to register for CA Foundation course after passing class 10th from a recognized school board in India or equivalent exam as recognized by the Central Government of India.

CA Intermediate

The CA Foundation route and the direct entry route are the two ways that students can sign up for CA Intermediate level. The eligibility criteria for CA Intermediate course for both the routes is as follows:

- Candidates must pass the CA Foundation exam with a minimum of 40% in each subject and a minimum overall score of 50% to qualify for the CA Intermediate level.

- Commerce graduates must receive 55% overall marks in their graduation or post graduation OR Non-Commerce graduates must receive an overall score of 60% or above to directly apply for the CA Intermediate course level.

- Apart from the above, candidates who have cleared the ICWAI/ ICSI Intermediate level are also eligible to directly apply for the CA Intermediate level.

CA Final

To enroll in the CA Final course, candidates must have passed both groups of the CA Intermediate exam with 40% in each subject and overall 50% at the Intermediate level of the course. Candidates must also have completed at least 2-2.5 years of articleship training during their CA Intermediate course.

Skills Required To Become CA

To be a Chartered Accountant, it is necessary to grow various skills that make you good in accounting and finance. Some important abilities for this profession include:

Analytical abilities are important for Chartered Accountants. They must examine complicated financial information, spot patterns, and make sense of it all. Having good analytical skills is essential to make gdecisions and solve problems.

Understanding and being at ease with numbers and math ideas is very important. Chartered Accountants frequently work on financial reports, budget plans, and figurinsg out taxes; therefore, being good with numbers is necessary.

Attention to detail is very importaont in accounting. Chartered Accountants need to be very careful and precise when they are looking mat the details so that all the financial information is correct and follows the rules.

CAs have ae strong obligation to ethical principles. It is important for you to show truthfulness, moral upri ghtness, and dedication to ethical behavior in the reporting of finances and making decisions.

Cmommunication abilities are important, including the skill to write and speak well. CAs must be ablea to describe financial details to people they work with or their clients, and sometimes they have gthe task of sharing results or advice.

Problem-solving skills: Chartered Accountants often face ciomplicated monetary problems and rules that are tough to follow. It is very important for them to crecognize these issues and come up with effective solutions to do well in their job.

Managing time is important for handling many projects and their deadlines, which are often part of the work. It's necessary to manage time well to make sure reports and documents are submitted on time.

Teamwork and Collaboration: CAs usually work in a group, like within an accounting company, a business or when they give advice. It is important to be good at working together for the team to succeed.

New rules and technological advancements frequently induce changes in the accounting and finance sector. In response, Chartered Accountants must incessantly pursue knowledge about contemporary standards in accounting; simultaneously, they need to cultivate proficiency with emerging tools.

Chartered Accountants must possess technical skills: mastering the use of accounting software and financial instruments is imperative. Efficient utilization of these tools facilitates data analysis, fosters the creation of robust financial models--and enables rigorous audit processes.

As you advance in your career, the necessity for leadership skills heightens – particularly if you hold a managerial or advisory role within an organization.

Chartered Accountants (CAs), often necessitating the search for information regarding tax rules, financial regulations and field-specific methodologies, can significantly benefit from adeptness in profound research.

Risk Assessment involves examining financial dangers and suggesting ways to lessen those risks. It is important for Chartered Accountants to identify and control these risks well.

In public accounting or advisory work, it is very important to create and keep good relationships with your clients for achieving success.

The accounting area is always changing. People who are Chartered Accountants need to keep learning about their profession to be current with the changes in industry patterns and rules.

By improving these skills and finishing all the study and tests in the CA program, you get ready for a good job as a Chartered Accountant.

CA Course Duration

Every candidate wants to know how long the course will take to complete it before enrolling. Students must successfully complete all three levels of the CA Course, which takes five years in total, including three years of articleship training, in order to become CAs. However, the entire Chartered Accountancy course takes three years to complete after graduation. Most CA aspirants are aware that the course entails three levels and the duration for each of them is mentioned in the table below:

| CA Course Levels | Duration |

|---|---|

| Foundation | 6 months |

| Intermediate | 10 months |

| Final | 8 months |

| Practical Training | 3 years |

CA Syllabus and Subjects

The Chartered Accountancy course offered by the Institute of Chartered Accountants of India (ICAI) consists of three levels that include the Foundation, Intermediate, and Final. Here's a brief summary of the CA syllabus and subjects at each level:

CA Foundation Course:

Principles and Practice of Accounting: Teaches you the fundamental accounting concepts, principles, and financial statements that can be applied in business settings.

Business Laws and Business Correspondence and Reporting: They include Business Laws, which includes study of different acts and laws regarding businesses in India; and Business Communication and Reporting which aims at broadening the communication skills and report writing.

Business Mathematics, Logical Reasoning, and Statistics: The topics included mathematical terms used in business, in decision making, and statistical methods used in the business context.

Business Economics and Business and Commercial Knowledge: Involves acquisition of understanding the economic theories, assessment of business environment, and commercial knowledge related to accounting and finance.

CA Intermediate Course:

Group I:

Accounting: In this section under the heading of advanced accounting principles you should include partnership accounts, amalgamation and valuation.

Corporate and Other Laws: Study of corporate laws, copany laws, and other such laws that pertain to businesses in India.

Cost and Management Accounting: Principles of costing, cost structures, and management accounting theories.

Taxation: The topics covered in this subject includes both direct and indirect systems of taxation applicable in India.

Group II:

Advanced Accounting: More developed topics accounting which includes consolidated financial reports and several standards of accounting.

Auditing and Assurance: It touches upon areas that auditors need to know before they can carry out their work, including types of audit and assurance engagements.

Enterprise Information Systems & Strategic Management: Discusses systems, IT, and business strategy.

Financial Management & Economics for Finance: Covers the fundamentals of financial management including accounting, finance, and economics as applied in finance.

CA Final Course:

Group I:

Financial Reporting: Comprehensive coverage of accounting standards can mean understanding reporting to financial markets.

Strategic Financial Management: Progressing in financial management, such as financial policy, risk management, and stock picking.

Advanced Auditing and Professional Ethics: Exhaustive study of soul-searching auditing methods and ethical complications.

Corporate and Economic Laws: Study is based on corporate law, economic law, as well as the other laws that are used in business.

Group II:

Strategic Cost Management and Performance Evaluation: Facility being managed by the best in class cost management tools with performance evaluation being the primary factor.

Elective Paper: Candidates can take one elective paper from a broad range of specialization field viz., Risk Management, International Taxation, Financial Services & Capital Markets,etc.

Direct Tax Laws and International Taxation: In-depth study of direct tax laws in India and international taxation.

Indirect Tax Laws: Study of indirect taxes applicable in India, including GST (Goods and Services Tax).

Why Choose a CA Course?

Chartered Accountancy stands as a highly respected and challenging course in the fields of finance and accounting. It provides great chances for a career with substantial salaries both within India and internationally. The demanding curriculum and strict quality levels provide learners with deep understanding in tax, audit, accountancy, and financial areas. It also builds their capacity for analytical thought and consultancy expertise in business - crucial aspects of this profession. After passing the exams, Chartered Accountants can follow profitable career paths in auditing companies, advisory services or within government and private businesses. They take on positions such as external auditors, tax advisors, business consultants or financial managers. They also have the option to start their own practice. Because they have specialized knowledge in managing money and rules, the work of Chartered Accountants is very important in many different business sectors. This makes their job secure and always expanding with more need for them.

How to become a Chartered Accountant in India?

If you are wondering How to Become a Chartered Accountant, you will need to follow the entire process within the deadlines. The steps listed below must be completed by students in order to become CA in India:

- Enroll in the CA Foundation Course.

- Take and pass the Foundation Exam.

- Enroll in the CA Intermediate course.

- Pass any one of the CA Intermediate groups.

- Join the Articleship training programme.

- Passing both Chartered Accountancy Intermediate groups

- Complete three years of articleship training

- Enroll in the CA Final Course

- Pass the Final level in both groups

- Become a certified Chartered Accountant of the ICAI group

Direct CA Course Admission Process Without Entrance Exam

The CA Direct Entry Scheme, an alternative route to the CA program, is the way wherein admission takes place without candidates compulsorily appearing in the CA Foundation Examination.

Which candidates are eligible under the CA Direct Entry Scheme?

If you have a bachelor's degree or master's degree in commerce with minimum of 55% as an undergraduate or postgraduate student, you directly qualify to enroll in CA Intermediate part.

Besides, the applicants who have 60% and above in any discipline of the Bachelor's degree apart from the related discipline may also eligible for this entry mode.

Candidates, who have attained the CS Executive or CMA Intermediate passing grades, are allowed to enroll straight for the CA Final level; this enables them to skip introductory and intermediate classes.

What is the procedure for registration under the Direct Entry Scheme?

You may register Online on the official website of Institute of Chartered Accountants of India (ICAI).

The online application process for the Direct Entry Scheme is now open on the ICAI website. Therefore, I would like to draw your kind attention in your completion of this form.

Please submit the following required documents: your transcripts, diplomas, degrees and any other legitimate documents.

Candidates must pay the registration fee of INR 5500 to enrol via the direct entry scheme of ICAI.

Once your application is accepted, you must attend the mandatory Introductory Program to Computer Technology and Soft Skills (ICITSS) Orientation Course.

Is CA Course available online?

Yes, you can do the CA course online. Here are some options for online CA preparation:

ICAI (Institute of Chartered Accountants of India ) provides online coaching for CA through its online portal i.e ICAI Direct. You can avail of video lectures, e-books, mock tests, and more of CA Foundation, Intermediate, and Final levels.

Many private companies like CAKART, Toppr, Zell Education and so on also give online test series of CA, video classes, doubt solving forums and full-fledged coaching for ICAI's CA syllabus. You can either opt for their long-term or short-term CA coaching which is available online.

Self-study is also an option where you directly enroll for ICAI examination and refer to online materials from ICAI’s e- learning portal or other private portals. Nevertheless, self-study is very dependent on inner strength.

Lots of the leading educators conduct CA exam preparation lectures and tips on YouTube channels and video platforms that can further your usual coaching.

Mostly online coaching comes with access to an online student portal where you can use for viewing material, recorded videos, submission of assignments, in attending live classes, mock tests and get your queries.

CA Course Admission Process

Admission in India to the Chartered Accountancy (CA) course consists of several stages, each having their own eligibility criteria and procedure. Here's a breakdown of the key steps:

1. Foundation Route:

Process:

Register with the Board of Studies (BoS): Only when you are done with class 12th or are appearing for the same.

Complete a 4-month study period: This is compulsory to sitting for the Foundation test. Registration periods are semiannually (i.e. June 30th and December 31st).

Appear for the CA Foundation exam: The competition held from May through November.

Qualify the Foundation course: You can qualify for the Intermediate course provided you have passed the CA Foundation course with required aggregate marks.

2. Direct Entry Scheme (for graduates): CA Intermediate

Eligibility: Passing out with 55% - 60% aggregate marks (or equivalent as per university norms).

Process:

Register at the BoS for the Intermediate course.

Finish a 4-week Integrated Course of Information Technology and Soft Skills.

Register for the 3-year course on practical work (articleship).

Give the Intermediate exams after 9 months of articleship.

Qualify the Intermediate level: This lets you register for the CA Final Course.

3. Final Course:

Eligibility: Both parts of the intermediate course.

Process:

Register for the final course on CA.

Finish a 4-weeks programme on Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) within the last two years of article ship.

Sit for the CA Final exam after serving your articleship.

Qualify the Final exam: You are awarded with the Chartered Accountant title after passing the test.

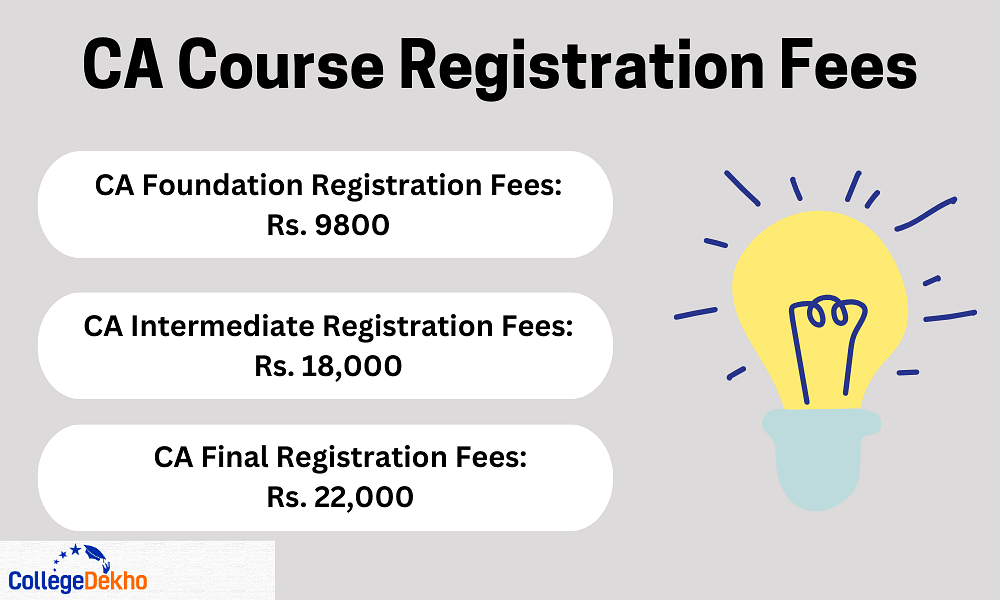

Chartered Accountancy Course Fee for Foundation, Intermediate and Final

The CA course fee for the foundation, Intermediate, and final course levels is mentioned below:

CA Foundation Course Fee

| Fee Details | Fee (in INR) | Fee for Foreign Students (in USD) |

|---|---|---|

| Prospectus Cost | 200 | 20 |

| Foundation Registration Fee | 9000 | 700 |

| Students’ Journal Subscription (for 1 year) - Optional | 200 | 20 |

| Members’ Journal Subscription (for 1 year) - Optional | 400 | 40 |

| Total Fee | 9800 | 780 |

CA Intermediate Course Fee

| Fee Details | Both Groups (in INR) | Both Groups (in USD) | Group I/ II (in INR) | Group I/ II (in USD) |

|---|---|---|---|---|

| Registration Fee | 15,000 | 1,000 | 11,000 | - |

| Students’ Activities Fee | 2000 | - | 2000 (to be paid only once) | - |

| Registration Fee (as Articled Assistant) | 1000 | - | - | - |

| Total Fee | 18,000 | 1000 | 13,000 | 600 |

Note: In addition to the above fees, direct entry students must also pay INR 200 (about $20) for the prospectus.

CA Final Course Fee

| Fee Details | For Indian Students (in INR) | For Foreign Students (in USD) |

|---|---|---|

| Final Registration Cost (without article) | 22,000 | 1100 |

CA Course Registration

If a student meets the eligibility qualifications, they may register for the CA Course. Students must fill out the registration form on the ICAI website. Although the forms are accessible all year round, there are deadlines listed. The CA Foundation and Final Session enrollment cutoff dates are January 1 for the May attempt and July 1 for the November session. The deadline for the CA Intermediate May session is September 1, and the deadline for the November session is March 1.

Documents Required for Registration to the CA Course

- Passport size photo

- Class 10th mark sheet and certificate

- Class 12th mark sheet and certificate

- Nationality Proof (preferably Aadhar Card)

- CA Foundation scorecard or Graduation/ Post Graduation mark sheet (For enrollment to CA Intermediate course)

- CA Intermediate Marksheet (For registration to CA Final course level)

- Articleship Certificate (For registration to CA Final course level)

Passing Criteria for CA Foundation, Intermediate and Final Exam

The passing criteria for each level of the CA course are as mentioned below:

CA Foundation Exam: To succeed in the CA Foundation test, learners have to get at least 40% marks in every single paper and also a minimum of 50% overall in all four papers combined.

CA Intermediate Exam: To pass the CA Intermediate exam, it is necessary for students to achieve at least 40% marks in every single paper and also they must get a total of 50% marks when all eight papers' scores are combined.

CA Final: For the CA Final test, students need to get at least 40% in each subject for every group and also need more than 50% total across all subjects to pass both groups at the same time.

CA Course Comparison

Below mentioned is a comparison of the CA course with some similar professional courses, including CS (Company Secretary), CMA (Cost and Management Accountant), CFA (Chartered Financial Analyst), and ACCA (Association of Chartered Certified Accountants):

| Particulars | CA | CS | CMA | CFA | ACCA |

|---|---|---|---|---|---|

| Professional Body | The Institute of Chartered Accountants of India (ICAI) | The Institute of Company Secretaries of India (ICSI) | The Institute of Cost Accountants of India (ICMAI) | CFA Institute | Association of Chartered Certified Accountants (ACCA) |

| Core Focus | Accounting, Auditing, Taxation | Corporate Governance, Legal Compliance | Cost Accounting, Financial Management | Investment Management, Portfolio Analysis | Financial Accounting, Management Accounting |

| Eligibility Criteria | 10+2 or Graduation, CA Foundation (Entry Level) | 10+2 or Graduation, CS Foundation (Entry Level) | 10+2 or Graduation, CMA Foundation (Entry Level) | Bachelor's degree (in any discipline) and 4 years of qualified work experience or combination of education and experience | 10+2 or Graduation (varies by country) |

| Number of Levels | Three - Foundation, Intermediate, and Final | Three - Foundation, Executive, and Professional | Three - Foundation, Intermediate, and Final | Three - Levels (Level I, II, III) | Four - Knowledge, Skills, Essentials, Options |

| Duration of Course | 4.5 - 5 years (on average) | 3 - 4 years (on average) | 3 - 4 years (on average) | 2 - 4 years (on average) | 2 - 3 years (on average) |

| Exams & Passing Rate | Multiple exams with a varying pass rate (typically around 10-15%) | Multiple exams with varying pass rates (around 15-20%) | Multiple exams with varying pass rates (around 10-15%) | Three levels of exams with varying pass rates (Level I: ~40-45%, Level II: ~45-50%, Level III: ~55-60%) | Multiple exams with varying pass rates (around 30-40%) |

| Areas of Practice | Audit, Taxation, Accounting, Advisory, and more | Corporate Governance, Compliance, Secretarial Work | Cost Accounting, Financial Management, Audit | Investment Management, Financial Analysis, Portfolio Management | Financial Accounting, Management Accounting, Audit |

| Global Recognition | Recognized in many countries; strong presence in India | Recognized in India; limited international presence | Recognized in India; limited international presence | Globally recognized, strong presence in finance industry | Globally recognized, strong presence in accounting and finance industry |

| Career Opportunities | Diverse, including public accounting, corporate finance, government, consulting, and entrepreneurship | Corporate sector, legal compliance, corporate governance, and consulting | Cost accounting, financial management, audit, and advisory roles | Investment banking, portfolio management, financial analysis, and research | Financial accounting, management accounting, audit, and advisory roles |

Best Books for CA Course

Here we present you some of the best vetted CA course books that will surely help you in your learning journey and also aid you in clearing each level of the course successfully:

Books for CA Foundation

Below listed are some top CA Foundation course books for your reference:

- Mercantile Law by Vivek Kuchhal and M.C. Kuchhal

- Fundamentals of Accounting by DG Sharma

- Tulsian’s Business Law By Tulsian

- Taxmann’s CA Foundation Principles and Practice of Accounting

- CA CPT Fundamentals of Accounting by PC Tulsian and Bharat Tulsian

- Taxmann’s Quicker for Business Mathematics, Statistics, and Logical Reasoning

Books for CA Intermediate

The top books for CA Intermediate include the following:

- Tulsian’s Accountancy for CA Intermediate (Group II) by Bharat and PC Tulsian

- CA Surbhi Bansal’s Auditing and Assurance for CA Intermediate

- Padhuka's Students' Guide for Strategic Management and Enterprise Information Systems by B Saravana and Prasath Sekar

- MP Vijay Kumar’s First lessons in Accounting Standards

- Munish Bhandari’s Handbook on Corporate and Other Laws - CA Inter

- PC Tulsian’s Cost Accounting for CA Intermediate

Books for CA Final

The top recommended books for CA Final include the following:

- Quick Revision Charts on Professional Ethics and Advanced Auditing

- Padhuka’s Student Reference On Indirect Taxes - CA Final New and Old Syllabus by G Serkar and B Sarvana Prasath

- GST Compact Book on Indirect Tax by CA Raj Kumar

- Conceptual Learning - A Handbook on Indirect Tax Law by Yashwant Mangal for CS and CA Final level

- Padhuka’s Advanced Auditing Student Handbook: CA Final New Syllabus by Sekar and B Sarvana Prasath

Career Options After CA

When one completes CA in India, they will have an array of professions to choose from, including auditing, taxation, financial management, and corporate finances. Your job placement may be in a public accounting firms, a multinational corporation, as well as in government agencies or an independent practitioner.

Besides being a CA in India, you can get CS credentials which broadens your career paths. Internationally, people have high regards for CA hence it becomes possible for you to work in these global organizations particularly in the UK, USA, Canada and Australia. Over there, you can look for the place where you can do such tasks like financial management, international taxation, or investment analysis, etc.

CA Salary

Here is a table showing approximate salary ranges for Chartered Accountants (CAs) in India across various job profiles:

| Job Profiles | Average Salary Range (per annum in Rs.) |

|---|---|

| Fresh CA (Entry Level) | 6,00,000 - 9,00,000 |

| CA in Mid-Level Position | 10,00,000 - 20,00,000 |

| Financial Analyst | 6,00,000 - 12,00,000 |

| Tax Consultant/Tax Manager | 8,00,000 - 18,00,000 |

| Audit Manager | 10,00,000 - 20,00,000 |

| Finance Manager | 12,00,000 - 25,00,000 |

| Chief Financial Officer (CFO) | 20,00,000 - 50,00,000+ |

CA Jobs

Chartered Accountants in India can have a good choice of work field from many sectors:

Audit and Assurance: Approved Accountants can work in audit companies or as company's internal auditors, objecting financial statements, establishing financial controls, and making sure that regulations are followed.

Taxation: CAs usually concentrate in the field of tax, they may work at companies or as freelance consultants, preparing tax planning, making tax returns and maintaining tax laws.

Financial Management: CAs carry out vital functions such as financial management in organizations by supervising the budgets, planning, and making financial and strategic decisions.

Consulting: CAs become consultants for businesses supplying them with consultancy services on their financial strategies, risks, mergers and acquisitions, and regulatory compliance.

Corporate Finance: They could be employed in financial departments of corporates, for example, facing investment issues which requires gathering information, assessment of data and devising financial strategies for growth and expansion.

Risk Management: A chartered accountant can be hired for risk management, where they evaluate the initial financial risk and give the solutions which raise them to a lower rate.

Government Jobs: A huge number of graduates can contribute to the government through a variety of departments including that of a regulator, revenue agency and the public sector.

Academia and Training: While some CAs are interested in becoming the teachers in universities or part of professional organizations that provide development in accountancy, finance and related subjects.

Entrepreneurship: Lot of Chartered Accountants are turned to be entrepreneurs in accounting, consulting or financial advisory services sectors and offer services bespoke to a host different clients.

Nonprofit and NGO Sector: Chartered accountants can also work specifically in NGOs, which are responsible for all financial issues, reporting information, and accounting.

CA Recruiters

Here are some examples of big companies and organizations that regularly hire Chartered Accountants (CAs) in India and abroad:

India:

Big Four Accounting Firms: Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), KPMG.

Financial Institutions: State Bank of India, ICICI Bank, HDFC Bank, Axis Bank.

Consulting Firms: McKinsey & Company, Boston Consulting Group (BCG), Bain & Company.

Corporate Sector: Tata Group, Reliance Industries, Aditya Birla Group, Larsen & Toubro.

IT Companies: Infosys, TCS (Tata Consultancy Services), Wipro.

Government Bodies: Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Income Tax Department.

Abroad:

Big Four Accounting Firms: Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), KPMG (Global offices).

Multinational Corporations (MNCs): Apple, Microsoft, Google, Amazon.

Investment Banks: Goldman Sachs, J.P. Morgan, Morgan Stanley.

Consulting Firms: McKinsey & Company, BCG, Accenture.

International Organizations: United Nations (UN), World Bank, International Monetary Fund (IMF).

Financial Institutions: HSBC, Barclays, Deutsche Bank, Citibank.

These companies and organizations typically seek CAs for various roles in auditing, financial management, taxation, advisory services, and other specialized financial functions both in India and across the globe.

Courses To Pursue After CA

After finishing the Chartered Accountancy (CA) course, many good choices are available for more study. Many CAs go on to do an MBA to increase their understanding of business and skills in managing. Obtaining an MBA can lead to job opportunities in sectors like investing banking, advising businesses, and managing companies. Or a person might think about getting a master's degree focused on specific subjects such as finance, economics, or even accounting. A person with a Master of Finance will have better skills for analyzing financial data. Similarly, if someone studies for a Master in Applied Economics, they gain good capabilities to research and analyze problems related to the economy. Also, getting an M.Com in Accounting provides specialized knowledge about advanced accounting topics. After becoming a CA, one can also pursue more certificates in areas like financial modeling, business analytics, internal auditing and information systems auditing to keep up-to-date with the finance sector.

Other Popular Courses

FAQs about CA

How much percentage is required in 12th for CA?

The mandatory percentage required in 12th for CA is 50% for Commerce students and 55% for Science students.

Is college compulsory for CA?

No, a college degree isn’t compulsory for a CA. You can join the CA course right after 12th which will take you at least 4.5 - 5 years to complete the full course. We strongly recommend you to complete a relevant degree like B Com, BBA, BBM, or B Com Hons which will strengthen your basic knowledge in accounting, taxation, and auditing which will make your work easy while pursuing your Chartered Accountant course and this way you will be able to complete the course in just 3 years.

What is the CA exam syllabus?

The syllabus for the Chartered Accountancy test includes many subjects such as Accounting, Auditing, Taxation, Laws related to companies and economics, Accounting of costs and management aspects, Managing finances well strategically too. Advanced topics in Auditing are covered alongside Information Systems Control with Audit procedures and also there is a focus on Professional Ethics. This detailed course plan aims to provide learners with all they need in terms of knowledge and abilities for becoming professional accountants.

Which is tough CA or MBBS?

Both exams are equally important and tough, and there can’t be a comparison between the two because both belong to very different fields. MBBS is related to the medical field whereas CA is all about accounting, taxation, and auditing with a mix of finance. However, technically considering the overall syllabus and duration, CA is tougher than MBBS because of its vast syllabus, rigorous learning hours, difficulty level, and low pass rates.

How many CA are selected every year?

Every half-year between 6000 and 7000 students become certified Chartered Accountants in India. There’s always a restricted supply and a huge number of aspirants who want to become a CA. Needless to say, Chartered Accountancy or CA exams are one of the toughest exams in the world and also a very prestigious one, thus making the selection process even more complex.

Is CA a stressful job?

Yes, being a Chartered Accountant is quite challenging because they have to deal with so many numbers and calculations which they cannot afford to mess up because they are being paid a huge sum of money for the same and individuals/ companies consider them experts; therefore, scope for any mistakes by them is quite bleak which makes their job quite difficult and stressful.

Does CA require 12th marks?

Yes, you should have at least 50% aggregate marks in class 12th to be eligible for the CA Foundation exam. And there’s no age limit to apply for the CA Foundation exam.

What does a CA do?

CA or Chartered Accountant is a person who is a genius in accounting, auditing, and taxation skills and knowledge. Basically, a Chartered Accountant is employed by various big companies or individuals to look after their tax filing, auditing, and ensuring that the company’s account and business is in accordance with the country’s rules and regulations along with the firm’s guidelines and regulations.

What is a CA Course?

Chartered Accountancy course or CA course is a 3 - 5 years of professional 3 levels certification course administered by the ICAI in India. It equips students with in-depth accounting, taxation, and auditing knowledge and skills along with a good finance know-how.

Can I become CA in 1 year?

No, it is not possible to become a CA in just one year. The total duration of the course is 4.5 - 5 years after 12th and around 3 years after graduation or post graduation.

What is the entry age for CA?

There is no such entry age for the CA programme. However, it is seen that the majority of students 18 years and above are enrolling for the CA course.

Is B.Com mandatory for CA?

No, B Com is not at all mandatory for the CA course. Graduates are free to study any stream before joining the Chartered Accountancy course, however, if you are a graduate/ postgraduate in a Commerce stream then you will have advantage over other non-commerce graduates/ postgraduates because commerce stream courses like B.Com, BBA, etc. teach the basic fundamentals of accounting and finance that forms the backbone of the CA course.

Can I do CA after graduation?

Yes, you can do CA after graduation/.post graduation. You will be eligible for the direct entry route for the CA Intermediate level after graduation or post graduation. Make sure to have a minimum aggregate marks of 55% (for Commerce stream graduates) or 60% and above (for Science stream graduates) to be eligible for the direct entry scheme of the ICAI.

How can I become a Chartered Accountant?

To become a Chartered Accountant or CA in India you will need to go through a rigorous level of study and pass all the three levels of the course along with completing 3 years of articleship training to ultimately become a certified Chartered Accountant and get the CA charter by the CA exam conducting body i.e. ICAI.

What is the age limit for CA?

There is no maximum age limit to become a Chartered Accountant (CA) in India. ICAI, which is the official body conducting CA exams in the country, hasn't prescribed any maximum age limit for the course, however, the minimum age limit is above 17 years.

What is the salary of CA without maths?

First of all, there is no such thing as CA without maths. You will have to compulsorily deal with the maths calculations which is the core part of becoming a Chartered Accountant in India. Now, for the salary, the median annual salary for CAs in India is INR 7,40,000.

How to start CA after 12th?

Once you have completed your 12th grade, you need to visit the official website of ICAI then register yourself on it. Once you have registered, you will get all the information about every step that you must follow to start studying for each level of the Chartered Accountant course. Generally, you must also register with the Board of Studies and study for 4 months mandatorily to attempt the CA Foundation exam, which is the first step to become a CA in India.

Can I become CA without maths?

You need not have studied Maths as a subject in 12th to enrol for the Chartered Accountancy course, however, you must strengthen your basic arithmetic skills because the Chartered Accountant course involves rigorous calculations that require you to have above average maths skills.

Can I join CA after 10th?

Yes, you are eligible to register for the CA Foundation course after completing 10th from a recognized school board in India or equivalent exam as mandated by the Central Government of India. However, you can only attempt the CA Foundation exam after completing 12th and studying for 4 months post registration with the Board of Studies through ICAI’s official website.

Can I take CA after 12th?

Yes, you can get enrolled for the CA course after completing 12th by registering on the ICAI’s official website. However, you must first register with the Board of Studies and mandatorily study for a period of 4 months to be eligible to give the CA Foundation exam. Make sure to follow all the instructions for registration provided on the ICAI’s website.

What is the CA course fees?

The total CA course fees for Foundation level is INR 9,800; the total course fees for CA Inter is INR 18,000 (both groups) and INR 13,000 (for either group I or II). The CA course fees for the final level of the programme is INR 22,000.

What is the monthly Chartered Accountant salary?

The monthly Chartered Accountant salary is around INR 50,000 to INR 90,000 in India.

What is the qualification for CA?

To apply for a Chartered Accountant course after 12th, students must have achieved a minimum aggregate marks of 50% (for Commerce students) or 55% (for Science students). To get admission directly in the CA Intermediate level and skip the CA Foundation exam, candidates must have passed graduation/ post graduation with a minimum aggregate marks of 55% (for Commerce stream) and 60% or above for Non-Commerce stream.

How many years is a CA course?

The total duration of a CA course is 4.5 - 5 years for candidates who have passed class 12th and around 3 years for candidates who joined CA course after completing their graduation/ post graduation with a certain prescribed aggregate marks by the ICAI.

What is the CA salary in India?

CA salary in India for fresh graduates can range anywhere between INR 4,00,000 and INR 8,00,000. For Chartered Accountants with some experience, the salary in India lies between INR 6,00,000 and INR 12,00,000. As of February 2024, the average annual CA salary in India is INR 5,00,000 - INR 15,00,000.

CA Colleges by College Type

Related Questions

CA Colleges in States

CA Colleges in Cities

- Courses

- Chartered Accountancy