MBA in Finance

An MBA in Finance is a two-year postgraduate degree that focuses on managing money, including planning, controlling, and overseeing financial resources. This specialisation prepares individuals for high-level careers in financial management, investment banking, corporate finance, and advisory services. They are equipped with the skills to make strategic financial decisions for organisations. After graduation, candidates can find job opportunities such as financial analysts, investment banking associates, finance managers, or financial advisors.

What is MBA in Finance?

MBA in Finance is a two-year postgraduate course concerned with the management of accounts and finances of companies to achieve specific financial objectives. It is the right choice for students with good financial knowledge and the ability to analyze and those with a deep-rooted understanding of financial models and the stock market. With the growing popularity of the MBA in Finance course, it can now be pursued full-time, part-time, executive, and online modes. The MBA in Finance syllabus includes a wide variety of subjects like Financial Management, Financial Planning, Cost of Capital, Pricing, Asset Management, Risk Management, etc.

MBA in Finance admission is based on merit and entrance exam scores like CAT, MAT, XAT, SNAP, NMAT, etc. Some of the top MBA in Finance colleges are XISS, MIT School of Business, MDI Gurgaon, IIM Kozhikode, and IIFT Delhi. The course fees range between INR 8 lakhs and INR 18 lakhs. Well-known institutes such as Sage University offer MBA in Finance job ready assured programs to equip students with technical, theoretical, and practical knowledge.

Some of the popular MBA in Finance jobs are Financial Analyst, Research Analyst, Account Manager, Risk Manager, Management Consultant, Insurance Manager, and Equity Analyst. The MBA in Finance salary for freshers ranges between INR 6 lakhs and 12 lakhs per year, which typically increases with experience and skills. Get complete MBA in Finance course details on this page.

MBA in Finance Latest Updates

- TS ICET 2024 application form was released on March 7, 2024, on the official website at icet.tsche.ac.in. TS ICET 2024 registration last date is April 30, 2024, without a late fee. The exam will be conducted on June 4 & 5, 2024.

- AP ICET 2024 application form was out on March 6, 2024, on the official website at cets.apsche.ap.gov.in. It will be available till April 7, 2024. The exam will be conducted on May 6 & 7, 2024.

- TANCET MBA 2024 was conducted on March 9 from 2.30 to 4.30 PM for admission to MBA colleges in Tamil Nadu. Candidates could apply for the exam until February 15, 2024. Anna University conducted the exam in offline mode (pen & paper mode).

- MAH MBA CET 2024 exam was conducted on March 9, 10 & 11, 2024, to shortlist students for MBA courses at B-schools in Maharashtra. Candidates who appeared for the exam can check out the detailed MAH MBA CET 2024 exam analysis.

Table of Contents

- What is MBA in Finance?

- MBA in Finance Latest Updates

- MBA in Finance Highlights

- Why Choose MBA in Finance?

- Who Should Pursue MBA in Finance?

- What is an Online MBA in Finance Course?

- What is the Difference Between MBA in Finance and Master in Finance?

- Types of MBA in Finance Courses

- MBA in Finance Eligibility Criteria

- MBA in Finance Entrance Exams in India

- MBA in Finance Admission Process

- Direct MBA in Finance Admission Process Without Entrance Exam

- MBA in Finance Course Fees

- MBA in Finance Syllabus

- Top Colleges Offering Specialized Job Ready MBA in Finance Courses

- Top Private MBA in Finance Colleges in India

- Top Government MBA in Finance Colleges in India

- Top MBA in Finance Colleges Offering Direct Admission in India

- Career Options After MBA in Finance

- Courses After MBA in Finance Degree

- FAQs about MBA Finance

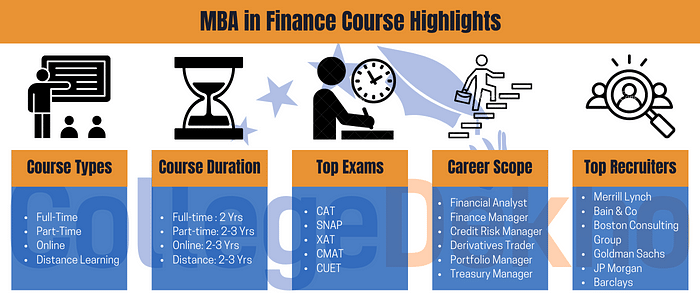

MBA in Finance Highlights

Check all the important MBA in Finance course details provided in the table below.

| Particulars | Details |

|---|---|

| Course Name | MBA in Finance |

| Course Level | Postgraduate |

| MBA in Finance Course Duration | 2 Years |

| Exam Type | Semester |

| MBA in Finance Qualification Requirement | Bachelor's degree in any stream with 50% marks |

| Selection Process | Entrance Exam + Scores in Bachelor’s Degree |

| MBA in Finance Entrance Exams | CAT, CMAT, XAT, SNAP, IBSAT, MAH MBA CET, etc. |

| Top MBA in Finance Colleges | IIM Kozhikode, IIM Calcutta, IIT Delhi, IIFT Delhi, MDI Gurgaon, XISS, NMIMS |

| MBA in Finance Course Fees | INR 8 to 18 Lakhs |

| Top Job Profiles | Financial Analyst, Finance Manager, Credit Risk Manager, Derivatives Trader, Portfolio Manager, Treasury Manager, etc. |

| Average Initial Salary | INR 6 LPA to 12 LPA |

| Recruiting Companies | Merrill Lynch, Bain & Co, Boston Consulting Group, Goldman Sachs, JP Morgan, Barclays, Deutsche Bank, Morgan Stanley, Lehman Brothers, McKinsey, etc. |

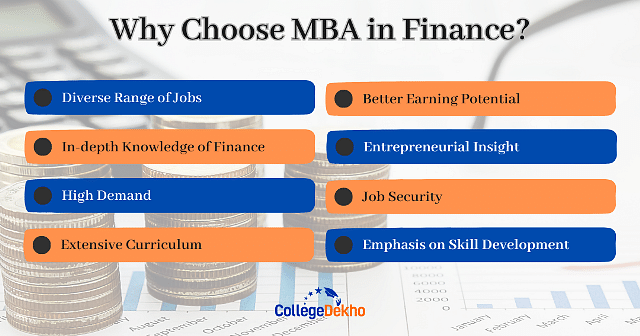

Why Choose MBA in Finance?

While deciding to pursue this course, some might wonder ‘Is MBA Finance a good degree?’ Well, getting an MBA degree seems a great investment for individuals who want to learn various aspects of business management and work at managerial levels. Here are some of the top reasons to go for it.

- Diverse Range of Jobs: Finance is a sought-after career domain in today's world. Skilled financial professionals are essential in managing cash flow, analysing investments, and making informed financial decisions. The increasing demand for financial experts provides ample job opportunities in various sectors, including healthcare and technology.

- Higher Salary: MBA in Finance graduates typically earn higher salaries, ranging from INR 7 LPA to INR 20 LPA. The pay scale varies based on expertise and experience. With the right skills, earning potential can increase significantly.

- In-depth Knowledge: This course offers a comprehensive and well-rounded education, with a focus on both general and advanced knowledge. The curriculum includes a variety of engaging learning experiences, such as management simulations, projects, and internships.

- Entrepreneurial Insight: An MBA in Finance teaches individuals how to manage financial resources effectively and efficiently. Graduates are well-prepared to navigate financial complexities, make informed decisions about financial planning, budgeting, and risk management, and secure funding for new ventures.

Who Should Pursue MBA in Finance?

The decision to pursue an MBA in Finance can be overwhelming for many students. If you are unsure if you are the right candidate for this course, read on to learn about the individuals who are best suited for it.

- Finance professionals already working in finance-related roles may pursue an MBA in Finance to deepen their expertise, advance their careers, and open up opportunities for leadership positions.

- Individuals from diverse academic and professional backgrounds who wish to transition into finance careers can benefit from an MBA in Finance.

- Aspiring entrepreneurs interested in starting their businesses or ventures can pursue the course to gain the knowledge and skills needed to launch and grow successful enterprises.

- Those in non-finance roles may pursue an MBA in Finance to enhance their understanding of financial principles and gain a competitive edge in their careers.

- Professionals looking to advance their careers and move into senior-level positions within their organizations may opt for an MBA in Finance to develop strategic, analytical, and leadership skills.

- International students or professionals seeking to enhance their global career prospects can pursue an MBA in Finance to gain exposure to international business practices, networks, and opportunities.

What is an Online MBA in Finance Course?

The online MBA in Finance course is specially designed for working professionals who aim to enhance their academic qualifications for better job prospects in the Finance industry. The program provides students with a comprehensive understanding of the financial landscape by integrating various concepts such as value maximisation, portfolio management, capital investment evaluation, and security analysis. MBA in Finance online course is an ideal choice for individuals seeking to develop their Finance Management expertise without compromising on their work commitments. The course curriculum is structured to offer a flexible learning experience with online classes, allowing students to manage their studies alongside their work and personal lives.

MBA in Finance online course fees is generally less as compared to traditional programs. Throughout the program, students are exposed to various finance topics, including financial reporting, risk management, investment banking, and corporate finance. The online MBA in Finance course content is designed to provide students with a deep understanding of the financial sector's inner workings, preparing them for a successful career in finance management. Overall, the online MBA in Finance course is an excellent opportunity for professionals looking to gain a comprehensive understanding of finance management, acquire valuable skills, and boost their career prospects.

What is the Difference Between MBA in Finance and Master in Finance?

MBA in Finance and Master in Finance are two of the most sought-after courses by candidates who want to make a career in the field of Finance. Check out the difference between the two mentioned in the table below.

| Point of Difference | MBA in Finance | Master in Finance |

|---|---|---|

| Duration | It is longer in duration, often ranging from 1.5 to 2 years, and it covers a broader range of business topics. | It is usually a shorter program, typically taking around 1 year to complete, as it is more focused on finance-specific coursework. |

| Experience Level | These programs often prefer or require candidates to have some professional work experience before admission. | These courses may accept students with little to no work experience, making them suitable for recent graduates who want to specialize in finance. |

| Career Opportunities | The broader nature of an MBA can lead to a variety of career paths, including finance roles but also extending to general management, consulting, and entrepreneurship. | This degree is more targeted, making it well-suited for individuals who have a clear career goal in finance, such as becoming a financial analyst, investment banker, or risk manager. |

| Scope | It provides a well-rounded education and is suitable for individuals who aspire to leadership roles in various business functions. | This degree is more specialized and suitable for those who want an in-depth understanding of finance. |

| Course Fees | INR 9,00,000 to 25,00,000 | INR 50,000 to 5,00,000 |

Also Read: MBA in Finance vs MBA in Marketing

Types of MBA in Finance Courses

MBA in Finance courses various offer options for students with specific requirements, allowing them to reach their career goals. Here are some popular types of MBA in Finance courses.

| Course Type | Details | Duration |

|---|---|---|

| Full-Time | A full-time course is a great choice for students who want to focus solely on their education, attend weekday classes, and engage in academic activities such as group projects, case studies, presentations, and exams. | 2 Years |

| Part-Time | Part-time courses are ideal for working professionals who have other commitments. Classes for part-time MBA in Finance are held on weekends and the course can be completed in up to three years. | 2-4 Years |

| Executive | Executive courses are designed for working professionals with 3-5 years of corporate experience. These courses aim to improve managerial skills, enhancing eligibility for corporate job roles. | 1-2 Years |

| Distance | Distance learning is an excellent choice for students who cannot commit to a full-time course due to other obligations. These courses can be completed from the comfort of your own home and some also provide hybrid classes. | 2-4 Years |

| Online | An online course is a flexible and convenient option for working professionals. The course allows you to study at your own pace and schedule, balancing it with work and other commitments. | 2-4 Years |

MBA in Finance Eligibility Criteria

One of the primary conditions that students must meet to be considered for admission is meeting the MBA in Finance eligibility requirements. Those who do not meet the eligibility criteria for an MBA in Finance course won't be able to pursue higher education in management regardless of their academic prowess. Check out the basic requirements for MBA in Finance admission in India

| Type of Course | Eligibility Criteria |

|---|---|

| Full-Time | Undergraduate degree or equivalent from a recognized university with at least 50% average marks. Reserved category candidates require a minimum of 45%. Final-year graduation students and professionals with CA/CS/ICWAI degrees can also apply. |

| Part-Time | Candidates must have a bachelor’s degree with at least 50% marks (45% for reserved category students) from a recognized university. Those in the final year of graduation can also apply but the admission will be subjected to the final aggregate score. |

| Online | You must have completed graduation from a recognized university with a minimum of 50% marks. Reserved category candidates require a minimum of 45%. Final-year graduation students and professionals with CA/CS/ICWAI degrees can also apply. |

| Distance | Candidates must have completed a bachelor's degree with a minimum of 50% marks from an accredited university. Reserved category candidates require a minimum of 45%. There is no age limit for eligibility. Final-year graduation students and professionals with CA/CS/ICWAI degrees can also apply. |

| Executive | Individuals must have a bachelor's degree with 50% (45% for reserved category students) aggregate or equivalent and 2-5 years of managerial or executive-level work experience. It must be noted that only full-time work experience will be considered. |

Skills Required for MBA in Finance

- Financial Reporting: Professionals need to present financial reports to stakeholders to help them understand the company's performance over time. Developing good financial reporting skills requires time and effort.

- Time Management: Employers value candidates who can effectively manage their time. This not only boosts productivity but also reduces stress and creates an environment of engagement and creativity.

- Business Intelligence: Graduates with an MBA in finance management must possess strong business acumen to make wise and informed decisions. They need to be proficient in forecasting revenues and predicting inventory, along with associated information. Additionally, they must be well-versed in enterprise resource planning software, such as SAP and Oracle ERP.

- Analytical Thinking: Developing analytical thinking is crucial for financial expertise. One must assess problems and devise effective solutions by managing both the technical and interpersonal aspects of finances.

MBA in Finance Entrance Exams in India

The top MBA in Finance colleges in India shortlist candidates for admission based on the entrance exam scores. Before applying for the entrance exam, students must check the requirements of their desired colleges. The following are the top MBA entrance exams for Finance specialization in India:

Common Admission Test (CAT)

CAT is the most popular MBA entrance exam in India, accepted by 21 IIMs and over 1000 colleges. This computer-based test is administered once a year by IIMs and is designed to evaluate the analytical and communication abilities of students. The exam is known for its high level of difficulty and competitiveness, which makes it a challenging yet rewarding experience for students who are looking to pursue a career in management.

Common Management Admission Test (CMAT)

CMAT is a highly sought-after national-level exam conducted by the National Testing Agency. The CMAT exam evaluates candidates' abilities across various segments, including Quantitative Techniques, Logical Reasoning, Language Comprehension, General Awareness, and Innovation and Entrepreneurship. The exam is designed to test the candidates' aptitude, analytical abilities, and problem-solving skills.

Xavier Aptitude Test (XAT)

XAT is a well-known national-level management aptitude test conducted by XLRI Jamshedpur to provide admission to Xavier-affiliated institutes and other MBA colleges in India. The competition for the XAT exam is intense, and it demands rigorous preparation. The test assesses the candidates on their analytical, quantitative, and verbal abilities, along with other vital skills.

Symbiosis National Aptitude Test (SNAP)

SNAP is a popular MBA entrance exam conducted by Symbiosis International (Deemed University) for admission to their MBA program. All Symbiosis institutes and many other prestigious business schools across India accept SNAP scores. The exam is an essential step for aspiring MBA students who seek to acquire quality education and advance their careers in the finance field.

NMIMS Management Aptitude Test (NMAT by GMAC)

NMAT by GMAC is a computer-based entrance exam conducted by the Graduate Management Admission Council (GMAC) in India. It is conducted once a year over a test window of 70-100 days, giving candidates the flexibility to choose their preferred test date and time. It consists of three sections: Language Skills, Quantitative Skills, and Logical Reasoning, with a total of 120 questions to be answered in 120 minutes.

Top MBA Entrance Exams Schedule

| Entrance Exam | Application Dates | Exam Date |

|---|---|---|

| CAT 2024 | August to September 2024 | November 24, 2024 (Expected) |

| CMAT 2024 | March 2024 | April/ May 2024 |

| XAT 2024 | July 15 to December 10, 2023 | January 7, 2024 |

| SNAP 2023 | August 23 to November 23, 2023 |

|

| NMAT by GMAC 2023 | August 1 to October 12, 2023 | October 10 to December 19, 2023 |

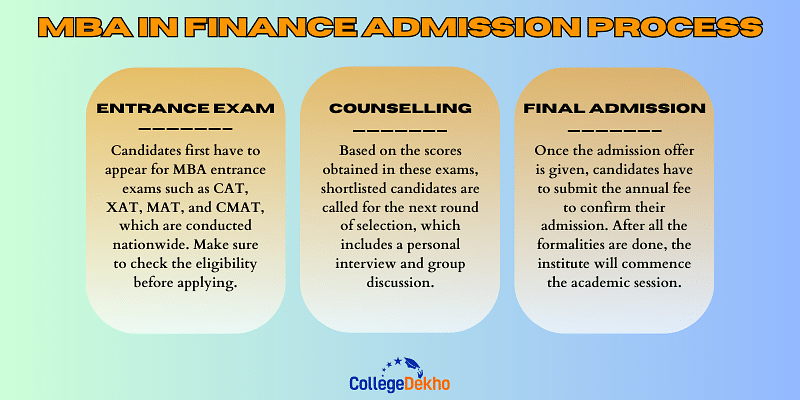

MBA in Finance Admission Process

The top MBA in Finance colleges in India offers admission based on the entrance exam scores. Below is the detailed MBA in Finance admission process conducted through MBA entrance exams.

- Appear for Entrance Exams: Candidates first have to appear for MBA entrance exams such as CAT, XAT, MAT, and CMAT, which are conducted nationwide. These exams test the aptitude, knowledge, and skills of the candidates in various subjects such as quantitative aptitude, data interpretation, verbal reasoning, and analytical ability.

- Participate in Counselling: Based on the scores obtained in these exams, shortlisted candidates are called for the next round of selection, which includes a personal interview and group discussion. This round evaluates the communication skills, confidence, and leadership qualities of the candidates. Candidates who successfully clear all the rounds are considered for admission to MBA in Finance.

- Complete Admission Formalities: Once the admission offer is given, candidates have to submit the annual fee to confirm their admission. The fee structure varies from college to college and usually includes tuition fees, hostel fees, and other miscellaneous charges. Candidates who fulfil all the criteria and complete the admission process successfully are eligible to pursue their MBA in finance and take the first step towards a bright career in the financial sector.

Direct MBA in Finance Admission Process Without Entrance Exam

When it comes to direct admission in MBA without entrance exam, there are certain steps that need to be followed. Firstly, students need to submit their application forms to the respective universities. After the application process is complete, a merit list is prepared on the basis of scores received in a Bachelor’s degree and evaluating the candidate's profile. The profile evaluation may include factors such as work experience, extracurricular activities, and other achievements.

Once the merit list is out, students may be called for an interview or a direct counselling session is held. During that, the candidate's profile is evaluated, and the suitability for the MBA in Finance course is assessed. If the candidate meets the requirements, they are notified of their selection. The next step is to pay the admissions and other related fees. Once the fees are paid, the candidate is officially admitted to the MBA in Finance colleges.

MBA in Finance Course Fees

MBA in Finance course fees is an important factor that influences the admission decisions of students. The type of institute, infrastructure, faculty, curriculum, placement scope, etc., decide the course fee of an institute. The following is the MBA in Finance course fees at top business colleges in India:

| Name of the College | Approx. Fees (in INR) |

|---|---|

| Jamia Millia Islamia, Delhi | INR 94,000 |

| MIT-SOB: MIT School of Business, Pune | INR 3.50 Lakh |

| BSE Institute Limited, Mumbai | INR 7 Lakh |

| IIT Madras | INR 8.07 Lakh |

| Institute of Public Enterprise, Hyderabad | INR 8.15 Lakh |

| IIT Roorkee | INR 8.5 Lakh |

| Xavier Institute of Social Service, Ranchi | INR 8.90 Lakh |

| Department of Management Studies, IIT Delhi | INR 11.20 Lakh |

| Woxsen University, Hyderabad | INR 12.20 Lakh |

| International School of Business & Media, Pune | INR 12.20 Lakh |

| International School of Business & Media, Pune | INR 12.20 Lakh |

| National Institute of Bank Management, Pune | INR 13.7 Lakh |

| IIM Kashipur | INR 17.30 Lakh |

| IIM Raipur | INR 18 Lakh |

| IIM Lucknow | INR 19.25 Lakh |

| KJ Somaiya Institute of Management Studies and Research, Mumbai | INR 20.87 Lakh |

| Narsee Monjee Institute of Management Studies, Mumbai | INR 21.9 Lakh |

| IIM Kozhikode | INR 22.50 Lakh |

| Management Development Institute, Gurgaon | INR 24.99 Lakh |

| Symbiosis Institute of Business Management, Pune | INR 26.79 Lakh |

| IIM Calcutta | INR 31 Lakh |

MBA in Finance Syllabus

The MBA in Finance syllabus develops an aptitude for analytical thinking and managerial decision-making, devising strategies for improved financial performance, and understanding the risks and profitability related to business. It gives in-depth training to drive revenue and reduce costs. Take a look at the semester-wise MBA in Finance subjects provided below:

| 1st Semester | 2nd Semester | 3rd Semester | 4th Semester |

|---|---|---|---|

| Management Concept & Organisation Behavior | Accounting for Managerial Decisions | Strategic Management | Corporate Governance and Business Ethics |

| Economic Analysis for Decision Making | Investment Analysis & Equity Research | Merchant Banking & Financial Services | Commodity Market and Futures |

| Financial Accounting & Reporting | Risk & Insurance Management | Financial Derivatives & Risk Management | Marketing of Finacial Services |

| Quantitative Techniques for Management | Mutual Fund Portfolio Management | International Financial Management | Accounting Standard and I.F.R.S. |

| Marketing Management | Business Regulatory Framework | Tax Planning & Management | Retail Management |

| Financial Management | Entrepreneurship & Project Management | International Accounting and Corporate Reporting | Macroeconomics and Policy |

| Business and Financial Environment | Research Methodology & Report Writing | Corporate Restructuring & Financial Reengineering | Infrastructure Finance |

| Financial Markets and Institutions | ICT, Soft Skills & Business Communication | Human Resources Management | Inclusive Finance |

Top Colleges Offering Specialized Job Ready MBA in Finance Courses

Go through the table given below to know the top colleges offering specialised job ready MBA in Finance courses:

| College Name | Course Fee (per annum) | How to Apply |

|---|---|---|

| Sage University Bhopal | Rs. 65,000 | Sage University Job Ready Degree |

| JECRC University (offers MBA in Global Financial Operations) | Rs. 1,25,000 | JECRC University Job Ready Degree |

Top Private MBA in Finance Colleges in India

Here are some of the top private colleges in India offering MBA in Finance along with their course fees and NIRF Ranking 2023:

| Name of the College | Course Fees | NIRF Ranking 2023 |

|---|---|---|

| Management Development Institute, Gurgaon | INR 24.99 Lakh | 13 |

| Symbiosis Institute of Business Management, Pune | INR 26.79 Lakh | 17 |

| Narsee Monjee Institute of Management Studies, Mumbai | INR 21.9 Lakh | 21 |

| KJ Somaiya Institute of Management Studies and Research, Mumbai | INR 20.87 Lakh | 45 |

| National Institute of Bank Management, Pune | INR 13.7 Lakh | 76 |

| Xavier Institute of Social Service, Ranchi | INR 8.90 Lakh | - |

| International School of Business & Media, Pune | INR 12.20 Lakh | - |

| Woxsen University, Hyderabad | INR 12.20 Lakh | - |

| Institute of Public Enterprise, Hyderabad | INR 8.15 Lakh | - |

| MIT-SOB: MIT School of Business, Pune | INR 3.50 Lakh | - |

Top Government MBA in Finance Colleges in India

Here are some of the top government colleges providing MBA in Finance course in India along with their course fees and NIRF Ranking 2023.

| Name of the College | Course Fees | NIRF Ranking 2023 |

|---|---|---|

| IIM Kozhikode | INR 22.50 Lakh | 3 |

| IIM Calcutta | INR 31 Lakh | 4 |

| Department of Management Studies, IIT Delhi | INR 11.20 Lakh | 5 |

| IIM Lucknow | INR 19.25 Lakh | 6 |

| IIM Raipur | INR 18 Lakh | 11 |

| IIT Madras | INR 8.07 Lakh | 15 |

| IIT Roorkee | INR 8.5 Lakh | 18 |

| IIM Kashipur | INR 17.30 Lakh | 19 |

| Jamia Millia Islamia, Delhi | INR 94,000 | 25 |

| BSE Institute Limited, Mumbai | INR 7 Lakh | - |

Top MBA in Finance Colleges Offering Direct Admission in India

Check out the top B-Schools in India offering direct admission to MBA in Finance without entrance exams.

| Name of the College | Total Fees |

|---|---|

| Asian Business School, Delhi | INR 8.25 Lakh |

| Auro University, Surat | INR 7.15 Lakh |

| Alliance School of Business, Bangalore | INR 15 Lakh |

| Christ Deemed University, Bangalore | INR 9.3 Lakh |

| Apeejay School of Management, Delhi | INR 8.7 Lakh |

| Amity University, Noida | INR 13.44 Lakh |

| Lovely Professional University, Jalandhar | INR 8 Lakh |

| R V Institute of Management, Bangalore | INR 2.78 Lakh |

| Indus Business Academy, Bangalore | INR 14.05 Lakh |

| Millennium School of Business, Delhi | INR 3 Lakh |

| School of Management Studies, Patiala | INR 1.79 Lakh |

| Narayana Business School, Ahmedabad | INR 5.85 Lakh |

| Universal Group of Institutions, Mohali | INR 1.60 Lakh |

| Indian School of Business Management & Administration, Ahmedabad | INR 49,900 |

| Annapoorna Institute of Management and Research, Hukkeri | INR 1.08 Lakh |

Career Options After MBA in Finance

After completing an MBA in Finance, candidates have the option to pursue lucrative career options both in private and public sectors such as financial firms and consultancies, banks, the stock market, trading, account management, and others. Check out the career options after MBA in Finance discussed below.

Top MBA in Finance Job Profiles

Listed below are suitable job roles for candidates with an MBA in Finance degree.

| MBA in Finance Job Profile | Job Description |

|---|---|

| Account Manager | An Account Manager is responsible for ensuring that every department within an organization meets the needs of its clients and customers. They cater to the complaints of customers, find solutions to them, and establish a positive relationship between both parties for future endeavours. |

| Business Analyst | A Business Analyst is responsible for analyzing large data sets to determine effective ways to boost the efficiency of a business. With the use of data analytics, they come to logical conclusions and forecasts from executing strategies that can enhance the performance of a business. |

| Finance Officer | A Finance Officer deals with all financial aspects of a business or organization. They are responsible for managing the budget, preparing financial reports, and ensuring that all financial transactions are executed legally and ethically. |

| Finance Manager | A Finance Manager deals with the distribution of financial resources of a business and is responsible for budget planning. They support the executive management team by providing financial advice and insights that allow them to make effective business decisions. |

| Research Analyst | A Research Analyst examines and validates the precision of the data to make sure that it delivers meaningful information. After collecting and analyzing the data, they use mathematical, statistical, and analytical models to find ways that can provide business opportunities. |

| Equity Research Analyst | The job role of an Equity Research Analyst is to conduct research, analyze financial information, create reports, and make forecasts regarding financial matters within an organization. They assist senior analysts in regard to investment decision research of a business. |

| Account Officer | An Account Officer is responsible for recording transactions, expenses & payments, and processing invoices. They also send out bills and invoices, follow up on overdue payments, and make sure that a business' invoices and payments match up perfectly by cross-checking the original document to the company's record. |

| Finance Executive | A Finance Executive is responsible for the money transactions, including income and expenses of a business. They ensure that the organization is profitable by determining ways to cut costs to maximize profits. They also manage cash-flow statements, tax planning, and budgeting. |

MBA in Finance Salary in India

The table below will give an estimation of the average salary for MBA in Finance job roles:

| MBA in Finance Job Role | Average Salary |

|---|---|

| Derivatives Trader | INR 3.25 LPA |

| Financial Analyst | INR 4.22 LPA |

| Private Equity Manager | INR 4.50 LPA |

| Asset Manager | INR 5.20 LPA |

| Credit Risk Manager | INR 9.20 LPA |

| Treasury Manager | INR 9.69 LPA |

| Finance Manager | INR 9.80 LPA |

| Corporate Banker | INR 10.50 LPA |

| Portfolio Manager | INR 10.71 LPA |

| Hedge Fund Manager | INR 12 LPA |

| Corporate Finance Manager | INR 15.30 LPA |

| Assistant Vice President - Corporate Banking | INR 20 LPA |

Top Recruiters for MBA in Finance Graduates

MBA in Finance graduates are hired by some of the top companies mentioned in the table below.

| Morgan Stanley | Bain & Co | Deutsche Bank |

|---|---|---|

| Merrill Lynch | Boston Consulting Group | Citi Bank |

| Barclays | McKinsey | KPMG |

| JP Morgan | Deloitte | ICICI Bank |

| Goldman Sachs | Lehman Brothers | HSBC Bank |

Courses After MBA in Finance Degree

If you aspire to climb up the corporate ladder and secure top managerial positions, having an MBA in Finance may not suffice. Pursuing advanced courses after completing an MBA can definitely enhance your skills and increase your earning potential. Here are some top courses that you may want to consider pursuing after obtaining an MBA in Finance.

| Courses after MBA in Finance | Average Cost | Average Salary |

|---|---|---|

| Financial Risk Management (FRM) | INR 1,00,000 | INR 2 LPA - INR 10 LPA |

| Chartered Financial Analyst (CFA) | INR 40,000 - INR 2,00,000 | INR 6 LPA - INR 12 LPA |

| Executive MBA | INR 4,00,000 - INR 15,00,000 | INR 20 LPA - INR 25 LPA |

| Fellowship Programme in Management | INR 6,00,000 - INR 13,00,000 | INR 10 LPA - INR 40 LPA |

| PhD in Management | INR 10,000 - INR 3,00,000 | INR 5 LPA - INR 10 LPA |

| Cost and Management Accounting (CMA) | INR 1,00,000 - INR 4,00,000 | INR 5 LPA - 20 LPA |

FAQs about MBA Finance

Why should I study MBA in Finance?

Individuals should pursue MBA in Finance as it offers a comprehensive set of financial skills and knowledge required to succeed as managers in in banking, investment management, corporate finance, or consulting. It can open doors to a wide range of high-paying and rewarding career opportunities.

Is knowledge of Maths compulsory for MBA in Finance?

Yes, knowledge of maths is compulsory for MBA in Finance. The course curriculum includes topics that require a basic understanding of accounting principles that involve numerical. Therefore, having a good grasp of mathematics will simplify the understanding of an MBA in Finance.

What is the selection process for MBA in Finance?

The selection process for MBA in Finance includes appearing for an entrance-based management aptitude test. On clearing the cut-off, students will be called for personal interviews and group discussions which will help the admission panel understand the abilities of the candidates. Then the final merit list will be prepared.

Is there any age limit for MBA in Finance?

No, there is no lower or upper age limit for MBA in Finance. However, as this is a master's level course, students above the age of 20 generally take up the course. There is no maximum age limit for MBA and can be done even in the 40s.

Which companies recruit MBA in Finance graduates?

The top companies that recruit MBA in Finance graduates are Infosys Ltd, Mahindra and Mahindra, Kotak, Tata Consultancy Services, Citi Bank, EY, and JP Morgan Chase and Co. To get recruited by these companies, candidates must have a strong academic record and excellent skills.

Can I apply for MBA in Finance after 12th?

No, you cannot apply for MBA in Finance after the 12th as it is a postgraduate degree and can be only pursued upon completing a bachelor's degree in any stream. There is no also definite subject requirement for pursuing MBA in Finance.

What is a part-time MBA in Finance?

A part-time MBA in Finance is a course that can be pursued along with a job. The classes are generally offered on weekends or evenings for the benefit of students. The total course duration can be a little more than a full-time MBA that is it may take around 3 years.

Is MBA in Finance costly?

The cost of MBA in Finance depends depend on the university where one is studying. The average tuition fees are between INR 4,00,000 and INR 10,00,000. That said, students with an extraordinary academic or extracurricular record may receive scholarships to study the course.

Is MBA in Finance difficult?

An MBA in Finance is as difficult as other specializations. However, as this course requires intensive knowledge of mathematics and statistics, it can be appalling for those whose strengths do not lie in these two subjects.

What skills are required for MBA in Finance?

An MBA in Finance requires a combination of soft and hard skills. While knowledge of the subject is pertinent to degree holders, they must also have leadership skills, problem-solving skills, corporate strategy skills, and good communication skills.

Should I study MBA in Finance in India or abroad?

You can study MBA in Finance both in India and abroad. While studying in India is cheaper, an MBA degree abroad may burn a hole in the pocket. Nonetheless, an MBA in Finance abroad will provide a global perspective and links with global industry experts.

What is an Executive MBA in Finance?

Executive MBA in Finance is a postgraduate programme especially suited for senior managers and executives. It is a two-year programme where professionals require at least five years of working experience. An executive MBA helps to build a strong professional network and earn the knowledge to function as a better manager.

What is the scope of MBA in Finance in India?

The scope of MBA in Finance in India is quite good as Finnace has become one of the most sought-after specializations in India due to the country's growing economy, expanding financial sector, and increasing demand for finance professionals across industries.

What is the eligibility criteria for MBA in Finance?

The eligibility criteria for MBA in Finance include a bachelor’s degree with at least 50% marks in graduation. Students must note that the eligibility criteria vary from college to college, so it is advised to check the detailed requirements before applying.

Who should study MBA in Finance?

Individuals who are interested to look after the financial aspects of an organisation must study MBA in Finance. Also, they must be interested in financial trends, balancing risks and profitability, and managing and maximising investment portfolios.

Is MBA in Finance good course?

Yes, MBA in Finance is a good course for those who want to make a career in investment banking, corporate accounting, private equity and etc. The course is the backbone of any business as finance is related to the collection and investment of money.

I have completed B.Tech. Can I apply for MBA in Finance?

Yes, you can apply for MBA in Finance after completing B.Tech. There is no particular subject requirement to study the course. Nevertheless, students from Science, Commerce, and Arts backgrounds can apply for MBA in Finance.

What is the starting salary after MBA in Finance?

Candidates can get an average salary of INR 5 lakh to INR 15 lakh per year after MBA in Finance. The salary is higher for those who have prior work experience be in the same field or other relevant sectors. With time and rising expertise, salary also increases.

What is the syllabus of MBA in Finance?

The syllabus of the MBA in Finance comprises topics such as Cost of Capital, Financial Planning, Cost Accounting, Advance Marketing, Finance Functions, and Cash Management. Besides these specialized topics, there are fundamental topics from business and management that are taught to students.

What is the duration of MBA in Finance?

The duration of an MBA in Finance is 2 years. In distance or online mode, the duration can be more than 2 years. There are certain MBA courses that can be completed in a year and working professionals hugely benefit from them.

Where I can apply for a job after completing MBA in Finance?

After completing MBA in Finance, you can apply for a job in many sectors such as financial firms and consultancies, banks, and stock markets. The popular job positions are financial analyst, cash manager, credit manager, equity analyst, investment banking consultant, and accounts manager.

What job profiles are available after MBA in Finance?

Some of the job profiles available after MBA in Finance are Account Manager, Business Analyst, Finance Officer, Finance Manager, Research Analyst, Equity Research Analyst, Accounts Officer, Finance Executive, and Assistant Manager.

What is the fees of MBA in Finance?

The average fees for MBA in Finance range from INR 15 lakhs to INR 25 lakhs for the entire course. The fee of the program will be different for all the colleges, so candidates must find out the fee structure before applying.

What are the top MBA in Finance entrance exams?

The top MBA in Finance entrance exams include CAT, XAT, SNAP, NMAT by GMAC, MAT, ATMA, CMAT, etc. The entrance exams are conducted at the national, state, and university levels to offer admission to MBA in Finance courses.

What are the top MBA in Finance colleges in India?

The top MBA in Finance colleges in India include IIM Calcutta, IIM Kozhikode, IIM Raipur, IIM Lucknow, IIT Delhi, IIT Madras, MDI Gurgaon, SIBM Pune, NMIMS Mumbai, XISS Kolkata, NIBM Pune, KJ Somaiya Mumbai, Woxen University, ISBM Pune, MIT School of Business Pune, etc.

Related Questions

Popular Courses

- Courses

- MBA Finance