Last Updated On 11 Aug, 2020

Personal Financial Advisor provides advises to the clients according to their need and requirements. Besides this, he also helps the clients plan their long term as well as short terms goals. Personal Financial Advisor offers advice on many things such as estate planning, insurance, mortgages, retirement, investment, college savings to help the clients manage their savings. He provides assistance to the clients while considering some important factors such as mitigating risk, avoiding costly errors and financial market. Most of the Personal Financial Advisor has its own expertise such as risk management or retirement planning.

Check some major responsibilities of a Personal Financial Advisor provided below.

Meeting with clients to discuss their goals and requirements

Resolving the doubts of clients regarding potential risks and investment options

Helping clients to plan their retirement

Analysing the financial performance of the clients and providing them with solutions to improve their financial performance

Explaining the type of service they offer to the clients

Providing them with a list of benefits they will offer them with the services

Check the minimum eligibility criteria for a career as a Personal Financial Advisor provided below.

Education Required |

|

Certification | Certified Financial Planner (CFP) certification provided by the Financial Planning Standards Board (FPSB) |

Skills | Some of the skills required for a Personal Financial Advisor are listed below.

|

The table provided below contains all the courses to become a Personal Financial Advisor. You can select these courses based on your qualifications. If you have completed a bachelor degree already then you can go for a bachelor degree in finance.

Course | Total Fee (Approx) | Top Colleges for Finance Planning/ Management |

Rs. 1.2 lakh to Rs. 8.30 lakh |

| |

Rs. 50,000 to Rs. 1.25 lakh | ||

Rs. 20,000 to Rs. 1.50 lakh | ||

Rs. 15,000 to Rs. 80,000 | ||

Rs. 50,000 to Rs. 2.00 lakh | ||

Rs.20,000 to Rs. 5.00 lakh | ||

Rs.25,000 to Rs. 2.12 lakh | ||

Rs. 30,000 to Rs. 75,000 |

If you are looking for admission to any of the course provided here then you can fill our Common Application form. Besides this, you can also call on our toll-free number 1800-572-9877 to get admission related assistance.

Two major types of Personal Financial Advisors are wealth managers and private bankers. They help clients while investing their money and planning retirement. Job roles of a Personal Financial Advisor depend on whether he is working for any organization or as an individual. There are some Personal Financial Advisors that pursue this profession as part-time. Some major job profiles where Personal Financial Advisor may apply for a job are provided below.

Financial Managers

Real Estate Brokers and Sales Agents

Insurance Sales Agents

You can ask more questions about the Personal Financial Advisor such as job profiles and annual salary on the Collegedekho QnA zone.

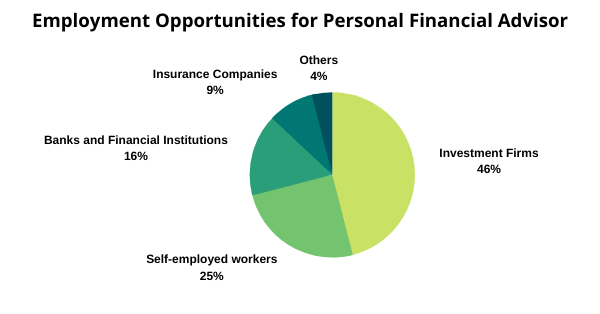

Most of the recruiters for Personal Financial Advisor belong to the Securities management and Financial investment sector. Some of the major employment opportunities for Personal Financial Advisor are Investment firms, Financial Planning firms and Insurance companies. You can check the graph provided below to know more employment opportunities available for a Personal Financial Advisor.

Some of the major recruiting companies for Personal Financial Advisor are listed below.

HDFC

Kotak Mahindra

HSBC

ICICI

Aditya Birla group

LIC

NIACL

Bajaj finserv

Life Insurance Corporation of India

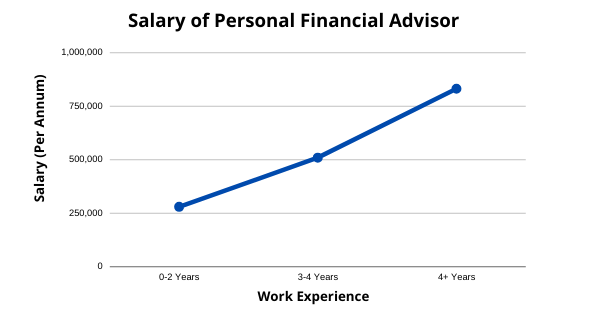

The average salary of a Personal Financial Advisor is INR 2 lakh per annum

Personal Financial Advisor who works at investment companies and financial services firms are also given bonus

A candidate who has good communication skills will earn more as a Personal Financial Advisor

A Personal Financial Advisor should have a good understanding of the financial market and investment strategies. He can refer to some of the important books provided below to gain more knowledge about financial markets and financial planning.

Storytelling for Financial Advisors by Scott West and Mitch Anthony

Endless Referrals by Bob Burg

The Nature of Investing by Katherine Collins

Ineffective Habits of Financial Advisors by Steve Moore and Gary Brooks

The Million-Dollar Financial Advisor by David J. Mullen Jr.

Questions Great Financial Advisors Ask by Alan Parisse and David Richman

Investment Leadership by Jim Ware, Beth Michaels, and Dale Primer

People consult a Personal Financial Advisor for taking meaningful advice.

Salary of a Personal Financial Advisor is not fixed. They can earn more depending on their capabilities.

He does not have to follow the 9-6 work routine.

This profile will help you understand the financial market.

Good analytical skills and maths skills are required for this profile

A Personal Financial Advisor can face difficulties in the initial stage of the career as people prefer taking advice from an experienced person

Work hours of Personal Financial Advisor are not limited

Most of the companies hire candidates who have at least 1-2 years of experience.

Take our test and find out if it suits your strengths.

Some of the major recruiters for a Personal Financial Advisor are ICICI, HSBC, LIC, Aditya Birla group and NIACL.

The best thing about being a Personal Financial Advisor is that your income is not limited. A candidate who has a work experience of 2-3 years will surely earn more in comparison to a fresher.

Some of the major job profiles available for a Personal Financial Advisor are Financial Advisor, Financial Analyst, Budget Analyst and Real Estate Broker.

Personal Financial Advisor can apply to Investment firms, Financial Planning firms or Insurance companies.

Some of the important skills required to become a Personal Financial Advisor are maths skills, analytical skills, communication skills and problem-solving skills.

It depends on your hard work and skills. You can become a good Personal Financial Advisor in 3-4 years.

Some of the best books for Personal Financial Advisor are ineffective Habits of Financial Advisors by Steve Moore and Gary Brooks and The Million-Dollar Financial Advisor by David J. Mullen Jr.

Salary of a Personal Financial Advisor is not fixed since they charge a commission on the investment amount of the client. His salary will vary depending on his work and skills.

Financial Planner helps the organization to prepare a plan to meet the short term and long terms goals while Financial Advisor provides investment advice.

A bachelor's degree in Finance, Economics or Mathematics is required to be a Personal Financial Advisor. Some companies also ask for a master's degree in a relevant field.