CBSE Class 12 Accountancy Answer Key 2024 (Image Credit: Pexels)

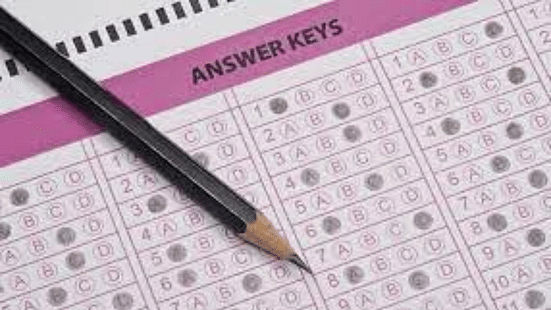

CBSE Class 12 Accountancy Answer Key 2024 (Image Credit: Pexels)CBSE Class 12 Accountancy Answer Key 2024: For the commerce stream students, CBSE Class 12 Accountancy 2024 examination was conducted on March 23, from 10:30 AM to 1:30 PM. As the exam has concluded, the answer key for the same is provided here for multiple question paper sets. The answers are provided only for the objective segment of the question paper i.e., for all the 16 questions from Part A, and 4 questions from Part B. The internal choices in the MCQs of Part A and Part B are also answered here.

Helpful link for next exam | CBSE Class 12 Business Studies Weightage 2024

Also Read | CBSE Class 12 Result Expected Release Date 2024

CBSE Class 12 Accountancy Answer Key 2024 for QP Code: 67/5/2 (Set 2)

Part A includes 16 multiple-choice questions of 1 mark each, the answers to which for Set 2 (QP Code 67/5/2) are provided here in tabular format.

Part A: Multiple-Choice Questions

| Question Number | CBSE Accountancy QP Code: 67/5/2 (Set 2) Answer Key 2024 |

|---|---|

| 1. Assertion (A): In partnership firm, the private assets of the partners can also be used to pay off the firm's debts. Reason (R): The liability of the partners for acts of the firm is limited. Choose the correct option from the following: | (D) Assertion (A) is true, but Reason (R) is false. |

| 2. Kewal Ltd. purchased sundry assets from Ganpati Ltd. for ₹ 28,60,000. The amount was paid by issuing fully paid shares of 100 each issued at a premium of 10%. The number of shares issued to Ganpati Ltd. were: | (D) 26,000 |

| 3 (a). Aditi, Sukriti and Niti were partners sharing profits in the ratio of 2:2:1. Sukriti died on 30th June, 2023. Net profit for the year ended 31 March, 2023 was 4,50,000. If the deceased partner's share of profit is to be calculated on the basis of previous year's profit, the amount of profit credited to Sukriti's Capital Account will be : | (B) ₹ 45,000 |

| 3 (b) Pawan, a partner was appointed to look after the process of dissolution of firm for which he was allowed a remuneration of ₹ 75,000. Pawan agreed to bear the dissolution expenses. Actual dissolution expenses ₹ 60,000 were paid by Pawan. Pawan's capital account will be credited by: | (A) ₹ 75,000 |

| 4. Sarita Ltd. forfeited 100 shares of ₹10 each, ₹8 called up issued at a premium of ₹2 per share to Ramesh for non-payment of allotment money of ₹5 per share (including premium). The first and final call of ₹2 per share was not made. Out of these 70 shares were reissued to Ashok as ₹78 called up for ₹10 per share. The gain on reissue will be: | (C) ₹ 350 |

| 5 (a). Ridhima and Kavita were partners sharing profits and losses in the ratio of 3: 2. Their fixed capitals were ₹ 1,50,000 and ₹ 2,00,000 respectively. The partnership deed provides for interest on capital @ 8% p.a. The net profit of the firm for the year ended 31st March, 2023 amounted to ₹ 21,000. The amount of interest on capital credited to the capital accounts of Ridhima and Kavita will be: | (C) ₹9,000 and ₹12,000 respectively. |

| 5 (b). Ruchika and Harshita were partners in a firm. Ruchika had withdrawn ₹ 9,000 at the end of each quarter, throughout the year. The interest to be charged on Ruchika's drawings at 6% p.a, will be : | (D) ₹ 810 |

| 6. On dissolution of a partnership firm, if realisation expenses are paid by the firm on behalf of a partner, then such expenses are debited to which of the following account: | (B) Partner's Capital Account |

| 7. Isha and Manish were partners in a firm sharing profits and losses in the ratio of 3: 2. With effect from 1st April, 2023, they agreed to share profits equally. On this date the goodwill of the firm was valued at ₹ 3,00,000. The necessary journal entry for the treatment of goodwill without opening Goodwill Account will be : | (A) Date 2023: April, 1 Particulars: Manish's Capital A/c. to Dr. Isha's Capital A/c. Dr. Amount (₹): 30,000 Cr. Amount (₹): 30,000 |

| 8 (a). Aarav Ltd. issued 10,000, 9% debentures of ₹ 100 each at a premium of 5%, redeemable at a premium of 10%. Loss on issue of debentures account will be debited by : | (B) ₹ 1,00,000 |

| 8 (b). Dove Ltd. issued 8,000, 11% debentures of ₹ 100 each at a premium of 5%. The total amount of interest on Debentures for one year will be : | (C) ₹ 88,000 |

| 9 (a). Kriti, Hina and Nidhi were partners sharing profits in the ratio of 3: 2: 1. Nidhi retired. On the date of her retirement, Workmen Compensation Fund stood in the Balance Sheet at ₹ 1,50,000. Workmen Compensation Claim was ₹ 1,20,000. How much amount of Workmen Compensation Fund will be credited to Nidhi's Capital Account? | (C) ₹ 5,000 |

| 9 (b). Rohit, Udit and Mohit were partners in a firm sharing profits in the ratio of 3:2:1. Mohit retired. The balance in his capital account after making the necessary adjustments on account of reserves and revaluation of assets and liabilities was ₹ 1,80,000. Rohit and Udit agreed to pay him ₹ 2,00,000 in full settlement of his claim. Mohit's share of goodwill in the firm was | (D) ₹ 20,000 |

| 10. Assertion (A): Securities Premium cannot be utilized for writing off loss on sale of a fixed asset. Reason (R): Securities Premium can be applied only for the purposes mentioned in the Companies Act, 2013. Choose the correct option from the following: | (B) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct reason of Assertion (A). |

| 11. Mahi, Ruhi and Ginni are partners in a firm sharing profits and losses in the ratio of 6 : 4 : 1. Mahi guaranteed a profit of ₹ 50,000 to Ginni. Net profit for the year ending 31 March. 2023 was ₹ 1,10,000. Mahi's Bhare in the profit of the firm after giving guaranteed amount to Ginni will be : | (A) ₹ 20,000 |

| 12. Opening capital of Keshav was : | (D) ₹ 52,000 |

| 13. Amount of interest to be charged on Hitesh's drawings will be : | (C) ₹ 300 |

| 14. A partnership firm has 45 partners. It wants to admit 7 more partners into partnership. Only _______ more partners can be admitted in the partnership firm according to Companies Act, 2013. | (C) 5 |

| 15. A, B and C were partners in a firm sharing profits and losses in the ratio of 1/2 : 1/3 : 1/4. D was admitted in the firm for 1/6th share. C would retain his 111 original share. The new profit sharing ratio will be: | (B) 21 : 14 : 18 : 12 |

| 16 (a). If all the forfeited shares are reissued, the balance, if any, left in the Forfeited Shares Account is transferred to: | (C) Capital Reserve Account |

| 16 (b). Raghav Ltd. forfeited 100 shares of ₹ 10 each issued at a premium of 20% for non-payment of first call of 3 per share and final call of ₹ 1 per share. The minimum price per share at which these shares can be reissued will be : | (A) ₹ 4 |

Part B (Option-I): Multiple-Choice Questions

Part B: Analysis of Financial Statements includes 4 multiple-choice questions of 1 mark each, the answers to which for Set 2 (QP Code 67/5/2) are provided here in tabular format.

| Question Number | CBSE Accountancy QP Code: 67/5/2 (Set 2) Answer Key 2024 |

|---|---|

| 27. Which of the following transaction will result in flow of cash? | (C) Received from debtors ₹ 74,000. |

| 28 (a). Shyam Sunder Ltd. is a financing company. Under which of the following activity will the amount of Interest paid on loan' be shown: | (D) Operating activity |

| 28 (b). Tax paid during the year ended 31st March, 2023 was ₹ 15,000, While calculating Net Profit before Tax and Extra ordinary items, the amount of provision for tax to be added is __________. | (A) ₹ 30,000 |

| 29. Which of the following is not a tool of Analysis of Financial Statements? | (C) Statement of Profit & Loss |

| 30 (a). Total Assets - ₹ 3,00,000 Non-current Assets - ₹ 2,60,000 Non-current Liabilities - ₹ 80,000 Shareholders Funds - ₹ 2,00,000 Current ratio calculated on the basis of above information will be : | (B) 2 : 1 |

| 30 (b). When Current Ratio is 4: 1, Current Assets are ₹ 60,000 and Quick Ratio is 2.5: 1, the amount of 'Inventory' will be : | (A) ₹ 22,500 |

CBSE Class 12 Accountancy Answer Key 2024 for QP Code: 67/4/1 (Set 1)

Part A includes 16 multiple-choice questions of 1 mark each, the answers to which for Set 1 (QP Code 67/4/1) are provided here in tabular format.

Part A: Multiple-Choice Questions

| Question Number | CBSE Accountancy QP Code: 67/4/1 (Set 1) Answer Key 2024 |

|---|---|

| 1. Kanha. Resham and Nisha were partners in a firm. Nisha had given loan of ₹ 1,00,000 to the firm 10% p.. The accountant of the firm in emphasizing that interest on loan will be paid 0% pa. At what rate the interest on loan will be paid to Nisha? | (B) 10% p.a. |

| 2. Gupta and Sharma are partners in a firm sharing profit in the ratio of 4:1 They admitted Preeti as a new partner for 1/4th share in the profits, which she arquired wholly from Gupta. New profit sharing ratio of Gupta, Sharma and Preeti will be | (B) 11:4:5 |

| 3. Aditya, Vishesh and Nimesh were partners in a firm sharing profits and losses equally. Aditya died on 1 July, 2023. Remaining partnera decided to continue the business of the firm and decided to share future profita in the ratio of 4:3. The gaining ratio of Vishesh and Nimesh will be: | (C) 5:2 |

| 4 (a). Vishant Ltd. invited applications for issuing 6,000 equity shares of ₹10 each at 10% premium. The issue was fully subscribed. The amount per share was payable as follows: On application ₹3, on allotment-3 (including premium), on first call - 3 and on final call - ₹2. Ashish the holder of 200 shares paid the entire money along with allotment. The total amount received on allotment was: | (B) ₹ 19,000 |

| 4 (b). M Ltd. forfeited 5,000 equity shares of 10 each issued at a premium of 10% for non-payment of final call off 2 per share. The minimum amount at which these shares can be reissued as fully paid up will be: | (B) ₹ 10,000 |

| 5. Assertion (A) Under the fixed capital method, partners capital accounts always show a credit balance. Reason (R): Under the fixed capital method, all items like share of profit or loss, interest on capital, drawings, interest on drawings are recorded in a separate account called partners' current account. Choose the correct alternative from the following: | (A) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A). |

| 6 (a). Vanya and Aanya were partnera in a firm sharing profit and losses in the ratio of 3:2. Their capital were ₹ 5,00,000 and 1,00,000 respectively. Vanya was entitled to interest on capital@ 8% p.a. and Aanya was entitled to salary 5,000 per month. The net profit before any appropriation was ₹ 1,75,000. Vanya's share in divisible profit will be: | (A) ₹ 45,000 |

| 6 (b). Omkar and Shiva were partners in a firm. Omkar was entitled to a salary of ₹20,000 p,a. while Shiva was entitled to a salary of ₹50,000 p.n. Net profit for the year ended 31 March, 2023 after charging salary of Omkar and Shiva was 5,60,000. The total amount credited to Omkar's capital account will be: | (D) ₹ 3,00,000 |

| 7. Assertion (A) : Interest on bearer debentures is paid to a person who produces the interest coupon attached to such debentures. Reason (R): Bearer debentures are transferred by way of delivery and the company does not keep any record of these debenture holders. Choose the correct option from the following: | (C) Assertion (A) is correct, but Reason (R) is incorrect. |

| 8 (a). Arnav Ltd. purchased assets worth ₹ 24,00,000, It issued 9% debentures of 100 each at a discount of 4% for payment of the purchase consideration. The number of debentures to vendor wore: | (B) 25,000 |

| 8 (b). On 1 May, 2023, Amrit Ltd. issued 10,000, 10% debentures of ₹100 each at a premium of 10% redeemable at a premium of 10%. Loss on issue of debentures will be: | (C) ₹ 1,00,000 |

| 9 (a). Riya, Rita and Renu were partners in a firm. On 31 March, 2023 Renu retired. The amount payable to Renu 2,17,000 was transferred to her loan account. Renu agreed to receive interest on this amount as per the provisions of Partnership Act, 1932. The rate at which interest would be paid to Renu is: | (B) 6% p.a. |

| 9(b). Ravi, Vani and Toni were equal partners in a firm. After the retirement of Vani, the capital balances of Ravi and Toni were ₹1,56,000 and ₹1,08,000 respectively. The new capital of the firm was determined at₹2,80,000. It was decided that the capital will be in proportion of the profit sharing ratio of the remaining partners. Toni will bring _________ for deficiency of his new capital | (D) ₹ 32,000 |

| 10. Interest on capital will be provided to Aditi and Saurabh in which of the following ratio? | (A) 5:4 |

| 11. Interest on Aditi's capital will be: | (B) ₹ 45,000 |

| 12. Vishnu and Mishu are partners in a firm. Mishu draws a fixed amount at the end of every quarter. Interest on drawings is charged 15% p.a. At the end of the year interest on Mishu's drawings amounted to 9,000円 Interest on drawings was charged on drawings of Mishu for: | (C) 4½ months |

| 13. On the dissolution of a partnership firm there were debtors of ₹ 34,000. Debtora of ₹ 1,000 became bad and 60% was realized from the remaining debtors. Which account will be debited and by how much amount on the realisation from debtors? | (C) Cash A/c by ₹ 19,800 |

| 14 (a). Which one of the following items is not dealt through Profit and Losa Appropriation Account? | (C) Rent paid to partners |

| 14 (b). At the time of admission of a partner, the Balance Sheet of the firm showed a workmen compensation reserve of ₹ ₹ 80,000. The claim for workmen compensation was estimated at ₹ 1,00,000. The shortfall of ₹ 20,000 will be: | (A) debited to Revaluation Account |

| 15. As per the provisions of Companies Act, 2013 Securities Premium cannot be utilized for : | (B) issue of partly paid bonus shares |

| 16. If vendors are issued fully paid shares of ₹ 1,25,000 in purchase consideration of net assets of ₹ 1,50,000, the balance of ₹ 25,000 will be credited to: | (C) Capital Reserve Account |

Part B (Option-I): Multiple-Choice Questions

Part B: Analysis of Financial Statements includes 4 multiple-choice questions of 1 mark each, the answers to which for Set 1 (QP Code 67/4/1) are provided here in tabular format.

| Question Number | CBSE Accountancy QP Code: 67/4/1 (Set 1) Answer Key 2024 |

|---|---|

| 27 (a). The tool of Analysis of Financial Statements' which helps to assess the profitability, solvency and efficiency of an enterprise is known as: | (D) Ratio Analysis |

| 27 (b). __________ is also known as the Acid Test Ratio. | (B) Quick ratio |

| 28. Quick ratio of Megamart Ltd. is 1.5:1. Which of the following transactions will result in decrease in this ratio? | (D) Creditors were paid ₹ 11,000. |

| 29 (a). Statement I: Financing activities relate to long term funde or capital of an enterprise." Statement II: Separate disclosure of cash flows arising from financing activities is important because they represent the extent to which expenditures have been made for resources intended to generate future income and cash flows. Choose the correct option from the following: | (A) Both Statement I and Statement II are correct. |

| 29 (b). What will be the effect of transaction Payment of employee benefit expenses' on the cash flow statement? | (A) Outflow from operating activities. |

| 30. From the above information, 'Cash flows from investing activities' will be: | (B) Outflow ₹ 3,20,000 |

CBSE Class 12 Accountancy 2024: Analysis and Question Paper

The analysis and question paper for CBSE Class 12 Accountancy 2024 held on March 23, 2024, can be checked at the following links:

CBSE Class 12 Answer Key 2024 Links |

The question papers for the respective day-wise exams are available at the links below:

CBSE Class 12 2024 Weightage Subject-Wise |

Access CBSE Class 12 weightage 2024 for the upcoming papers here in the given table:

| Subject | Weightage Link |

|---|---|

| Political Science | CBSE Class 12 Political Science Weightage 2024 |

| History | CBSE Class 12 History Weightage 2024 |

| Sociology | CBSE Class 12 Sociology Weightage 2024 |

| Computer Science | CBSE Class 12 Computer Science Weightage 2024 |

| Informatics Practices | CBSE Class 12 Informatics Practices Weightage 2024 |

Follow us

Follow us